Today I received a phone call from a CPA who was trying to help her clients who have a "toxic mortgage". She was hoping I would be able to save them…there was a time that I probably could perform a "rescue". In fact it was just a few months ago before the current mortgage melt down. Believe it or not, when applied correctly, subprime mortgages could mean the difference of someone being able to save their home assuming they were able to be disciplined enough to keep (or get) their finances healthy. This family will not qualify for FHA or FHASecure (they don’t have an ARM that’s adjusted). What they need is a subprime (now known as "non-prime") mortgage to buy them a little time. Now their time is running out.

Today I received a phone call from a CPA who was trying to help her clients who have a "toxic mortgage". She was hoping I would be able to save them…there was a time that I probably could perform a "rescue". In fact it was just a few months ago before the current mortgage melt down. Believe it or not, when applied correctly, subprime mortgages could mean the difference of someone being able to save their home assuming they were able to be disciplined enough to keep (or get) their finances healthy. This family will not qualify for FHA or FHASecure (they don’t have an ARM that’s adjusted). What they need is a subprime (now known as "non-prime") mortgage to buy them a little time. Now their time is running out.

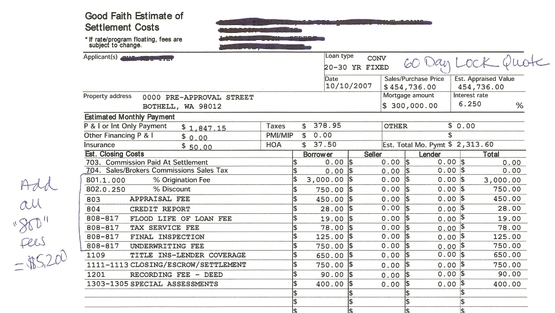

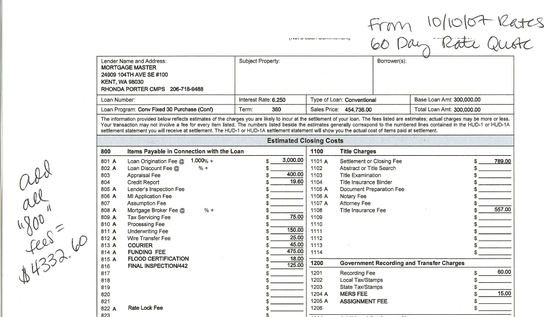

Part of their problem began with working with an unsavory loan originator who is now out of the business. The LO brokered their loan to a subprime company I would not work with. (Even though we’re approved with around 80 lenders, give or take depending on the day, I tend to select 5 preferred prime lenders and 3-5 subprime/alt-a…this lender was not on my list of preferred).

Shortly after closing, their lender informed them that they did not have home owners insurance…they did. They provided documentation showing their insurance to the lender. The lender did not respond and instead, ordered insurance for them at a hefty price…jacking up their payment beyond what they can afford. Now they’re sliding down a very slippery slope and the lender is not cooperating. They are behind on their mortgage a couple months. They called out for help too late.

NOTE: Other lenders may be more willing to cooperate with homeowners…you need to act quickly and contact your lender if you’re having difficulty with your payment.

Homeowners: the very moment you think you may be having trouble with your mortgage or debts, please contact your Mortgage Professional right away. If you don’t have one, you can always contact your CPA or other trusted financial advisor for a referral. Please don’t wait until you have a "mortgage emergency"…get help, even if you just have the sniffles.

Trusted Advisors (Real Estate Agents, CPAs, CFPs, etc): Please keep an ear out for your clients who may have adjustable rate mortgages or are may be having difficulites with their mortgage payment. Even if an ARM isn’t scheduled to adjust for 12 months or more, the sooner someone meets to with a Mortgage Professional to make sure their credit and everything else is in line to restructure the mortgage (if needed), the better for all.

All home owners should meet with their Mortgage Professional at least annually to have a "mortgage check up" or Annual Review. This is a service that I provide to my clients. I’ll provide more information about the Annual Mortgage Review in a separate post.

My point is, the more time you allow yourself to fix a "sick" mortgage situation, the better your odds are of finding a cure.

Recent Comments