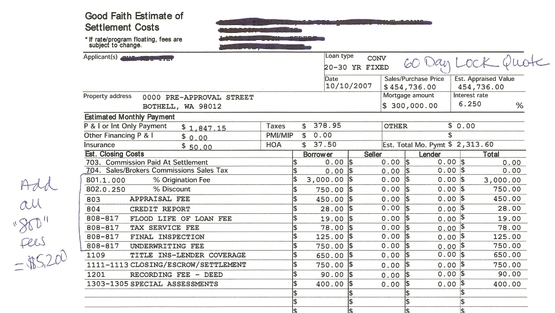

Earlier a Mortgage Porter reader contacted me regarding working with their Builder’s Loan Originator. They faxed their Good Faith Estimate to me to help review their closing cost fees associated with the rate. You can click on either estimate for a larger view. Here is the Builder’s preferred lender’s estimate 30 Year at 6.25% (APR 6.4246%):

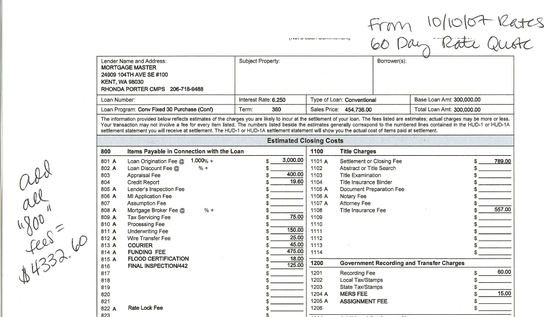

Here is my estimate 30 Year Fixed at 6.25% (APR 6.442%):

When comparing good faith estimates:

- Make sure you’re obtaining the same lock periods (in this case, both estimates are for 60 Day Locks) and that you’re getting your estimates at the same time on the same day (I used a rate sheet from October 10, 2007).

- Add up all the costs shown in Section 800 of the Good Faith Estimate. The total cost for the Builder’s GFE is $5200 and my GFE total cost is $4332.60. This is a difference of $867.40 (my estimate has lower costs).

- Ask each LO if they will guarantee the closing costs shown in Section 800. If they don’t, ask why not and listen hard. There’s no reason a LO cannot back up the closing costs they promote on a GFE once a borrower is approved and the loan is locked.

NOTE: The Builder Lender’s APR is lower than what I’m quoting, yet my APR is higher even though my costs are lower for the same rate. This is once again evidence why you DO NOT SHOP YOUR MORTGAGE BY APR.

I’m assuming the buyer has signed a purchase and sale agreement with the Builder who is offering a $5,000 closing costs credit if the buyer works with their lender. They’re charging a 0.25% Discount Fee (shown on Line 802 of both estimates) where I would not. The buyer should ask the builder’s lender why they’re charging a discount for that rate for 60 days when other lenders are not.

When you’re receiving a credit from a builder, you certainly want to make sure that you are receiving the full benefit and that it’s not being absorbed by the lender.

Discover more from The Mortgage Porter

Subscribe to get the latest posts sent to your email.

I am surprised the builder is even that close to you…

Most of the time the builders are so far out of the market it isn’t even funny. One or two points in origination fees and the rate is probably has another 2% of YSP/SRP built in.

The cost of the higher priced loan often eclipses the “free” granite countertops and other incentives builders use to trap consumers.

With the rate I’m quoting, I’m receiving approx. 0.3% YSP. That’s why I don’t understand the builder’s rep charging an additional 0.25% up front (because we know they’re getting approx. 0.3% on the back end too).

Bottom line, if the rep won’t guarantee the GFE, who knows what a buyer may have at signing.

Very interesting and helpful.

Q: Is the builder’s lender a broker or a bank? How can we know what the builder’s lender is earning for a YSP?

I don’t see it in the 800 series.

Thanks,

J.

Hi Jillayne, The builders lender GFE does not show any SRP or YSP. The GFE shows the lender as a dba “builder lender”. I cannot tell if they are a bank, correspondent or broker. I’m assuming they’re not a broker since they’re not disclosing YSP/SRP.

I’m estimating what they other lender would earn on the back end based off of what I know we would receive on the back end.

Rhonda-

Excellent real world nuts and bolts example and explanation. Bravo.

Understanding and ability to explain same should be minimum base-line competency requirement for all agents representing buyers… unless, of course, you to do it for them ;-).

An unsigned, un-guaranteed GFE is a red flag about the same size as the space needle.