If you’re one of my long time readers, you probably know that April Fools is an extra special day for me. Not only is it the day I my husband and I married six years ago, it also marks the day that I began my mortgage career at Mortgage Master Service Corporation back in 2000. Yesterday we celebrated our happy anniversaries with a walk through Sculpture Park in Seattle, lunch at Latona Pub (seriously the best hamburgers in Seattle) and a stop at Daniel Smith’s to pick up some more paint and supplies during their clearance sale…and wrote a preapproval letter for a couple who are getting ready to buy their first home using an FHA insured mortgage.

If you’re one of my long time readers, you probably know that April Fools is an extra special day for me. Not only is it the day I my husband and I married six years ago, it also marks the day that I began my mortgage career at Mortgage Master Service Corporation back in 2000. Yesterday we celebrated our happy anniversaries with a walk through Sculpture Park in Seattle, lunch at Latona Pub (seriously the best hamburgers in Seattle) and a stop at Daniel Smith’s to pick up some more paint and supplies during their clearance sale…and wrote a preapproval letter for a couple who are getting ready to buy their first home using an FHA insured mortgage.

What may impact mortgage rates this week: April 2 – April 7, 2012

10 Factors of Pricing a Mortgage Interest Rate Quote

As an established Mortgage Originator in the greater Seattle area, I’m often asked, “what are the current rates” and that’s often answered with “that depends on pricing a mortgage rate”.

As an established Mortgage Originator in the greater Seattle area, I’m often asked, “what are the current rates” and that’s often answered with “that depends on pricing a mortgage rate”.

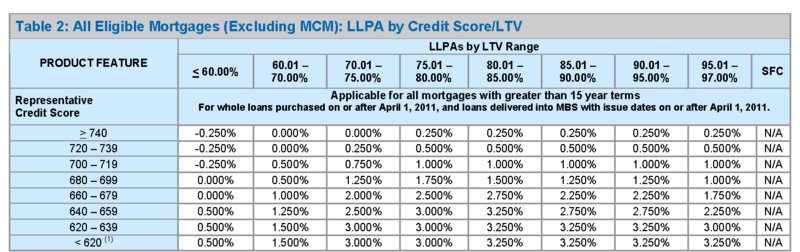

Mortgage rates have layers of risk factored into them. Fannie Mae refers to them as LLPAs (Loan Level Price Adjustments).

Mortgage Rate Movers for the Week of March 12, 2012 and the FOMC Rate Decision

Mortgage rates are based on mortgage backed securities (bonds) and may change throughout out the day. Investors will seek the safety of bonds when stock markets are deteriorating. The reverse is true: good news for the economy (as well as inflation) tend to cause mortgage rates to rise.

What May Move Mortgage Rates the week of March 5, 2012

This week ends with probably one of the most important scheduled economic indicators: The Jobs Report. Not only does the Jobs Report reveal whether or not more Americans are going back to work, it also indicates signs of inflation (wage inflation). Both good news and inflation may cause mortgage rates to trend higher. Numbers that are weaker than expected may cause rates to improve. This is because mortgage rates are based on mortgage backed securities (bonds) and investors will either seek the safety of bonds or possible improved returned with stocks depending on data.

This week ends with probably one of the most important scheduled economic indicators: The Jobs Report. Not only does the Jobs Report reveal whether or not more Americans are going back to work, it also indicates signs of inflation (wage inflation). Both good news and inflation may cause mortgage rates to trend higher. Numbers that are weaker than expected may cause rates to improve. This is because mortgage rates are based on mortgage backed securities (bonds) and investors will either seek the safety of bonds or possible improved returned with stocks depending on data.

LIVE POST: Mortgage Rates for Washington State and other Mortgage Miscellany

We have a lot of economic reports scheduled to be released this week which may influence mortgage interest rates. Here’s a snapshot of what’s on deck:

Monday, February 27: Pending Home Sales

Tuesday, February 28: Durable Goods and Consumer Confidence

Wednesday, February 29: GDP, Chicago PMI and the Fed’s Beige Book

Thursday, March 1: Personal Income, Initial Jobless Claims, Personal Core Expenditures (PCE), Personal Spending and ISM Index

There are many factors that impact the pricing of a mortgage rate. If you would like me to provide you with a rate quote based on your personal scenario for a home located anywhere in Washington, please click here.

Mortgage Rate Market Movers for the Week of February 13, 2012

We have plenty of economic indicators on the plate for this week not to mention to continued Euro-story. Remember, positive information, when the stock market is doing well or data that indicates positive inflation tends to cause mortgage rates to rise. Mortgage rates are based on bonds (mortgage backed securities) and investors tend to trade the safety of bonds for better return found with stocks when possible.

There are no economic indicators scheduled for today and the DOW is currently up 34 at 12,836 as I publish this post on 7:45 am PST on February 13, 2012.

Here's are a few reports that are scheduled for this week:

Tuesday, February 14, 2012: Retail Sales. HAPPY VALENTINES DAY!

Wednesday, February 15, 2012: Empire State Index, Industrial Production, Capacity Utilization and FOMC Minutes

Thursday, February 16, 2012: Building Permits, Housing Starts, Producer Price Index (PPI), Initial Jobless Claims and Philadelphia Fed Index

Friday, February 17, 2012: Consumer Price Index (CPI)

Today's my first day back from a couple days off at Mortgage Tech Summit in Scottsdale so I won't have time to update this post with live rate quotes. I will share live rate quotes on Twitter AND I'm happy to provide YOU with a no obligation mortgage rate quote for your home located anywhere in Washington state. For your personal mortgage rate quote, click here.

Do I have the best rate possible?

One of my preapproved first-time home buyers asked me if they have the “best rate possible”. The phrase “best rate” can mean different things to different people, in my opinion, the most common definitions to a borrower would be:

- best rate possible based on qualifying; or

- lowest rate possible based on current market pricing.

Best rate based on qualifying means that your credit scores are as high as they can possibly be and you’re putting enough money down (or have enough equity) to where there are as few price adjustments to your scenario.

With FHA loans, there are no price improvements after a credit score of 720 or higher. There is a slight improvement to mortgage insurance premiums with FHA at 5% down. With FHA a 720 score with 5% down will provide you the “best payment”.

With conventional financing, you can see by Fannie Mae’s chart below that there are different price adjustments based on credit score and loan to value. The best pricing on this chart is with 40% down (or equity) with credit scores of 700 or higher. There are additional charts for conventional depending on program features, such as an adjustable rate or the Home Affordable Refinance.

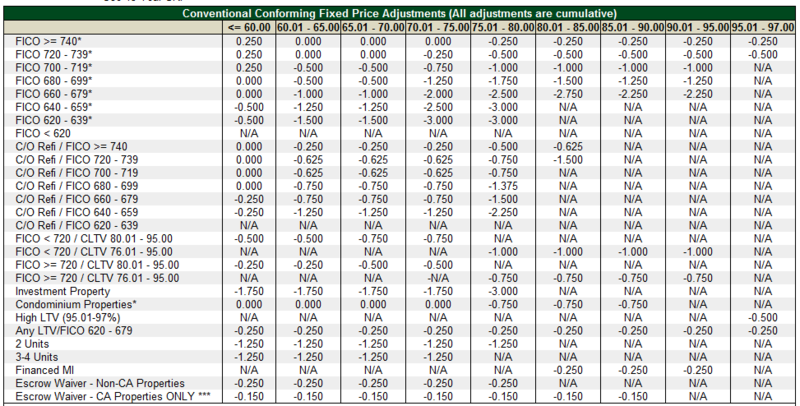

Below is a chart from a lender showing various adjustments based on program, credit score and loan to value.

If you’re interested in obtaining the best rate possible based on qualifying, consider starting the preapproval process very early so that you have time to work on your credit, debts and/or down payment. I enjoy helping my clients develop a plan to put them in best possible situation based on their scenario. Sometimes this may take a month or two and sometimes it may be a year or more, depending on what my clients situation is.

Best rate based on pricing may be the very lowest rate available at that moment, which would take paying additional discount points and would increase your closing cost. Some might think “best rate” is lowest rate at the least amount of cost (par pricing or using rebate pricing). Whether you want your rate priced with discount (higher fees/lower rate) or rebate credit to pay for closing cost (lower fees/higher rate) is up to the borrower.

Keep in mind that mortgage rates are a moving target, much like buying stocks. Rates often change several times a day. A mortgage interest rate is only secure once it is locked. Once you pull the trigger to lock in a rate, rates may improve or deteriorate. You can lock in a rate once you have a signed around contract with a specific closing date if you’re buying a home. If you’re refinancing a home, you can lock in whenever you know what your approximate closing date should be.

Mortgage originators are restricted from advertising that they have the “best rate” since this is something a lender cannot guarantee. It’s impossible to know what all our competitors are currently offering in pricing and therefore, no lender can truly say they have the “best” or “lowest” rates.

As a correspondent lender, we work with several banks and lenders and utilize a pricing engine which compares their mortgage rates based on a borrower’s specific scenario so that we can select who has the most competitive pricing at that time available to our company for that borrower.

If you’re considering buying a refinancing a home anywhere in Washington, from Redmond to Walla Walla (and everywhere in between), I’m happy to help you with your mortgage needs. Click here for your personal rate quote.

LOCK IN SOON!! Mortgages will Cost More thanks to Temporary Payroll Tax Cut

UPDATE: Since publishing this post this morning, another major bank announced a significant increase in their extension fees as noted below.

If you obtain a new mortgage next year for a refinance or purchase (for any purpose) and it is securitized by Fannie Mae or Freddie Mac or insured by FHA, you're helping to pay for the recently passed payroll tax cut bill.

From the FHFA:

“On Dec. 23, 2011, President Obama signed into law the Temporary Payroll Tax Cut Continuation Act of 2011. Among its provisions, this new law directs the Federal Housing Finance Agency (FHFA) to increase guarantee fees charged by Fannie Mae and Freddie Mac( the Enterprises) by no less than 10 basis points from the average guarantee fees charged by these companies in 2011 on single-family mortgage-backed securities. This requirement is effective immediately, meaning that the average guarantee fees charged in 2012 need be at least 10 basis points greater than the average guarantee fees charged in 2011 and that this increase be remitted to the U.S. Treasury, rather than retained as reserves by the Enterprises…. FHFA will announce plans for further guarantee fee increases or other fee adjustments that will then be implemented gradually over the two-year implementation window, taking into consideration risk levels and conditions in financial markets…"

What I'm seeing from some of the various banks and lenders we work with ranges from announcements they're increasing their extension fees 0.25% 0.40% across the board and other lenders announcing fee increases to up to 0.5% to take effect in the next couple weeks.

On a $400,000 loan, a 0.5% fee to interest rate increase means you'll be paying $2000 more for the same rate once the fee increases go into place!

With a rate lock extension, currently the charge from one bank who has announced the price increase, 7 days cost 0.125% and now with the 0.4% add, the 7 day extension cost 0.525%. Where an extension before would have cost $500 on a $400,000 loan, now it will cost $2,100 for the same seven days! This will force many borrowers to consider longer rate locks in order to avoid such a hefty penalty.

What can you do?

If you are considering refinancing your mortgage, contact your local mortgage professional to discuss current rates and securing your lower (pre-fee) rate today. If your home is located anywhere in Washington state, I can help you.

If you are buying a home and are in contract, but not yet locked, you may want to investigate locking.

Whether you are buying or refinancing your home, make sure that the lock is for a long enough period to avoid possibly higher extension fees.

Different lenders have different guidelines and ways they're implementing their fee structures. One of the benefits of working with a correspondent lender, like Mortgage Master Service Corporation, is that I work with several different banks and lenders and can filter out who is offering the most competitive price for your program at the moment you are ready to lock.

If you would like a rate quote for your home located in Washington, click here or contact me.

Recent Comments