When a mortgage rate is locked, it’s committed for a certain period of times, such as 30, 45 or 60 days. When a mortgage refi or purchase that has been locked does not close by that date, the lender may charge a fee to extend. The fee is essentially the cost to buy additional days to add to the original lock commitment.

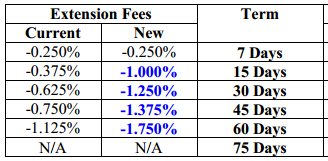

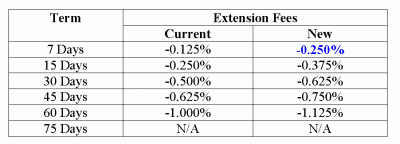

I just received this notice from one of the lenders we work with that they’re dramatically increasing their extension fees and, even worse, they’re only giving us ONE DAY’S NOTICE! Kind of stinky if you ask me. This is the same bank that increased their fees just over a month ago. The bank is doing this as a result of the 0.10% increase to G-Fees by Fannie Mae and Freddie Mac.

Thankfully we work with several lenders and we’re not limited to only working with this bank.

More often than not, it’s better to error on having a longer lock period than a shorter one and paying for an extension.

UPDATE: Another bank just announced they are increasing their pricing by 0.500% basis points to their rates (not extension) as a result of the “G Fees”.

Recent Comments