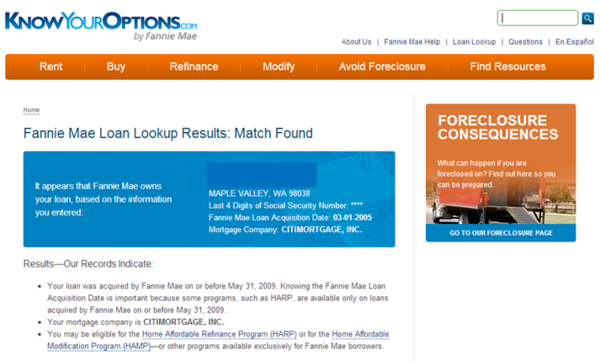

FHFA has published their 2012 Refinance Report which includes some interesting stats on the Home Affordable Refinance Program (aka HARP 2.0). HARP 2.0 is a program to help home owners who have lost home equity refinance their property as long as the mortgage was securitized by Fannie Mae or Freddie Mac prior to June 1, 2009. You can learn more about HARP 2.0 by checking out my guide.

December’s refinance report revealed that since the inception of HARP 2.0, over 2 million home owners have benefited from a HARP refinance.

- 88% of HARP refinances have been owner occupied/primary residence

- 9% have been for investment properties

- 3% were second or vacation homes

According to the FHFA Refinance Report, 25% of the transactions in December were for homes that were significantly underwater, with loan to values over 125%. Almost half the refinances were for homes with loan to values over 105%.

One of the benefits of a HARP 2.0 refinance is that it allows the home owner to refinance without getting new private mortgage insurance regardless of loan to value. If the home owner currently has pmi, it needs to transfer to the new HARP refi (this happens in a majority of cases).

The report states that 18% of those who did a HARP refinance in December 2012 opted for shorter terms (15 or 20 year) instead of a 30 year fixed.

Remember, the HARP 2.0 program is set to expire on December 31, 2013.

If your home is located in Redmond, Renton, Ravensdale or anywhere in the State of Washington, where I’m licensed to originate mortgages, I am happy to help you. Click here if you would like a mortgage rate quote.