This question is from a comment on one of my blog post addressing HARP 2.0’s eligibility date (Home Affordable Refinance Program), which many home owners have found to be a source of frustration. In order to qualify for the HARP 2.0 program, the mortgage must have been securitized by Fannie Mae or Freddie Mac prior to June 1, 2009. Securitization takes place after the closing of the loan and is completely out of the borrowers control.

This person is being told their loan was securitized YEARS after it closed in 2003. It is possible that the lender had to wait a long period of time before being able to sell the loan to Fannie.

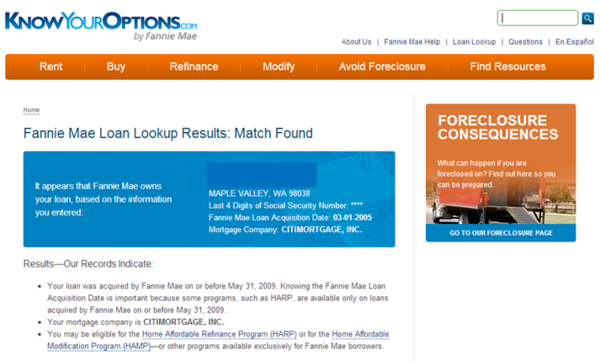

I highly recommend checking Fannie Mae’s site at https://www.knowyouroptions.com/loanlookup to verify if and when your mortgage is securitized by Fannie Mae.

Fannie Mae recently made improvements to their loan lookup site with getting rid of their terrible (sometimes comical) “bot” filter by replacing it with the borrowers last four of their social.

You will need to enter in the information of the primary borrower from when the mortgage was obtained. The site can be picky as to your address, for example, Ave vs Avenue; so you may have to try re-submitting your information.

“Match Found” means that Fannie Mae shows they have a mortgage on this property and that it may qualify for HARP 2.0. The improved site also provides the date the loan was securitized. A “match found” response does not guarantee that someone will qualify for the HARP 2.0 refinance program.

Back to my reader…

Should you verify with Fannie Mae’s site that your property was securitized with Fannie Mae prior to June 1, 2009, I would contact a local licensed mortgage professional to help you with your HARP 2.0 refinance.

I’m not sure what “independent site” was used to verify. Fannie Mae’s site would be the ONLY site I would use for verification of a Fannie Mae securitized mortgage.

Should you find that your mortgage was securitized after the June 1, 2009 cut-off date, you may have to wait and see if Congress passes HARP 3.0 (aka #myrefi) which hopefully will remove the cut-off date.

In my opinion the cut-off dates with the HARP 2.0 programs are hurtful for consumers who had no control over when their mortgage was securitized by Fannie Mae or Freddie Mac. I hope HARP 3.0 is available soon. When and HARP 3.0 is available, I will be sharing that information here on my blog.

By the way, Freddie Mac also has a website for verifying if your mortgage was securitized by Freddie. If your conforming loan was not securitized by Fannie Mae, the next step is to try Freddie Mac’s site to look up your loan: https://ww3.freddiemac.com/corporate/ Fannie Mae has a majority of the “market share” which is why I recommend trying Fannie Mae first.

If your home is located anywhere in Washington State, I’m happy to help you with your HARP(or any) refinance.

Discover more from The Mortgage Porter

Subscribe to get the latest posts sent to your email.

It is my understanding that the director of the FHFA already has authority to change the cutoff date. So potentially this could be fixed without HARP 3.0 if Director Edward DeMarco could be persuaded to change the date. Does this sound correct? If so perhaps President Obama could step in to help. DeMarco was appointed by the President and a gentle nudge from the commander in chief might be helpful in getting the date extended.