Last month, HUD increased FHA mortgage insurance rates on both upfront and annual (paid monthly) premiums. Borrowers who are considering an FHA high balance (aka FHA jumbo) loan amount, will see another increase to FHA mortgage insurance next month.

Effective on case numbers issued on or after June 11, 2012, FHA annual mortgage insurance premiums for "high balance" FHA loan amounts by 0.25 bps. In the greater Seattle area (King, Snohomish and Pierce counties), this impacts loan amounts between $417,001 to $567,500 for 1-unit properties.

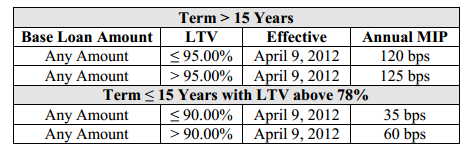

Currently, FHA high balance mortgages have annual insurance premiums per the table below.

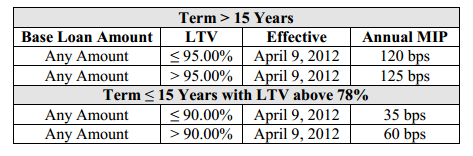

Effective with FHA case numbers issued June 11, 2012 and later, the annual mortgage insurance premium for FHA jumbos will look like this:

Term greater than 15 years

- LTV equal or less than 95% = 145 bps

- LTV greater than 95% = 150 bps

Term 15 years or less with LTV above 78%

- LTV equal or less than 90% = 60 bps

- LTV greater than 90% = 85 bps

FHA annual mortgage insurance is paid monthly. To determine how much the annual mortgage insurance will impact your monthly mortgage payment, multiply the base loan amount by the bps.

Today, a Seattle home with a 95% LTV and an FHA Jumbo 30 year fixed with a base loan amount of $560,000 would have an a monthly mortgage insurance of $583.00 (560,000 x 1.25% = 7,000 divided by 12 months = 583.33).

With FHA Case numbers issued as of June 11, 2012 or later, the same Seattle home will have a $116.67 higher monthly mortgage premium. (560,000 x 1.50% = 8,400 divided by 12 months = $700.00 per month).

If you are considering an FHA Streamline refi in the greater Seattle area (King, Pierce or Snohomish counties) and your loan amount is $417,001 to $567,500 and you obtained your FHA loan after May 2009, you may want to start your refi now! NOTE: If your existing FHA mortgage was endorsed by HUD prior to June 1, 2009, you qualify for reduced FHA mortgage insurance premiums. If you would like a rate quote, click here.

If you are considering buying a home or are in contract to buy a home and you have an FHA jumbo, make sure your mortgage professional obtains your FHA case number prior to June 11, 2012.

I'm happy to help you with your FHA mortgage if your home is located any where in the state Washington.

Recent Comments