Hot off the press! HUD just released Mortgagee Letter 12-4 addressing all of the changes to FHA mortgage insurance premiums. *Unless your doing an FHA streamlined refinanced of a mortgage that was "endorsed" on or before May 31, 2009; your FHA mortgage insurance premiums are going up.

Upfront mortgage insurance premium increasing effective April 9, 2012. Currently the rate is 1% of the loan amount. Effective with case numbers issued April 9, 2012 and later, the premium will increase to 1.75%.

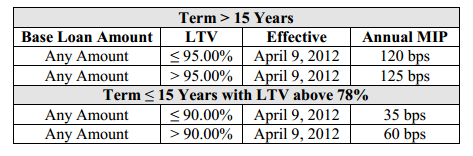

Increase to annual mortgage insurance premiums go into effect April 9, 2012. This increase is due to the Temporary Payroll Tax Continuation Act of 2011. NOTE: if you have a 15 year amortized FHA mortgage with a 78% loan to value, there is no annual mortgage insurance premiums.

FHA's annual mortgage insurance is paid monthly. The bps is multiplied by the FHA base loan amount to determine the premium and then divided by 12 months. A $100,000 loan with a loan to value over 95% would have an annual MIP of $1200. Divide this by 12 and the monthly premium is $100.

High Balance FHA annual mortgage insurance premiums will increase an additional 25 bps with case numbers assigned on or after June 11, 2012. In the greater Seattle area, this will impact FHA loan amounts of $417,001 to $567,500. If you have a higher FHA loan amount originated on or after June 11, 2012, add an additional 25 bps to the figures in the table above.

The above increases will impact all newly originated FHA mortgages for purchase and refinances, unless the home owner qualifies for the new reduced mortgage insurance rates with an FHA streamlined refi. The changes to mortgage insurance do not apply to FHA's reverse mortgages. Keep reading…

FHA Streamlined Refinances will have reduced FHA mortgage insurance premiums IF the FHA loan being refinanced was *endorsed on or before May 31, 2009 effective on case numbers issued on or after June 11, 2012. Upfront mortgage insurance premiums will be reduced from 1% to 0.01% of the base loan amount and the annual mortgage insurance will be reduced to 0.55% of the loan amount. Borrowers must be current on their existing FHA insured mortgage.

If your FHA loan being refinanced was endorsed June 1, 2009 or later, then the reduced rate does not apply. Your FHA mortgage insurance rates will be increasing based on the information above effective April 12, 2012.

NOTE: *Endorsed means when FHA actually insures the mortgage. This often happens months after closing!

If I can help you with your FHA refinance or purchase for your home located anywhere in Washington, please contact me.

Related post:

FHA Mortgage Insurance to increase April 2012

FHA to reduce mortgage insurance premiums for some FHA streamlined refi's

Discover more from The Mortgage Porter

Subscribe to get the latest posts sent to your email.

Please leave a reply