Effective October 1, 2011, several changes are set to take place that will impact new mortgages, including Conforming, FHA and USDA loans. These changes will impact home buyers, home owners considering refinancing and some who are trying to sell their homes.

Effective October 1, 2011, several changes are set to take place that will impact new mortgages, including Conforming, FHA and USDA loans. These changes will impact home buyers, home owners considering refinancing and some who are trying to sell their homes.

Archives for August 2011

October Brings Few Treats for Mortgages

VA Loan Limits to Remain Unchanged in 2011

VA has announced they are keeping their existing loan amounts through the end of 2011 instead of reducing them, like conforming and FHA loan amounts are set to do. From VA's website:

The maximum guaranty for VA guaranteed loans closed October 1, 2011 through December 31, 2011 will remain unchanged. The Veterans’ Benefits Improvement Act of 2008 provided a temporary increase in VA loan limits for loans closed January 1, 2009 through December 31, 2011. Because of this legislation, VA loan limits will remain the same for the remainder of the calendar year. Please note that VA does not have a maximum loan amount. Loan limit refers to the maximum loan a lender could make and still receive a 25% guaranty from VA, assuming the veteran has full entitlement.

Currently (and for the remainder of 2011) in King, Pierce and Snohomish County, qualified Veterans can have a loan amount of $500,000 and still have zero down payment. Loan amounts above $500,000 have a down payment of 25% of the difference between the sales price and loan amount. You can read more about VA loan limits (VA Jumbos) in Washington state here.

If you're a Mortgage Porter subscriber, then you know that in just a matter of a couple weeks, we're going to see Conforming and FHA loan limits reduced (technically "rolled back") effective on October 1, 2011 (loans must be funded and sometimes, delivered prior to this date). Congress may still take action to keep the existing loan amounts through the end of this year, however I'm thinking that is unlikely. Currently the loan limit for a single family home in the Seattle area for FHA and conforming loans is $567,500, it is set to be reduced to $506,000. Loan amounts $506,001 and higher will be considered "jumbo" soon.

HUD Issues Mortgagee Letter Addressing Lower Loan Limits for FHA Loans

Last Friday, HUD released Mortgagee Letter 11-29 announcing the maximum loan limits for FHA loans effective October 1, 2011 through December 31, 2011. FHA loan amounts are set to be reduced effective October 1, 2011 and many who have a "high balance" or FHA jumbo loan may be "caught in gap" if they do not close in time.

In the Seattle/King County area, FHA maximum loan amounts are set to be reduced from $567,500 to $506,000. Kitsap County will see their maximum FHA loan limit drop to $307,000. You can see an entire list of Washington Counties and the new FHA maximum loan amounts here.

The Mortgagee Letter does state that FHA to FHA refinances "may exceed new loan limits" which is a bit of good news for those who currently have a high balance FHA loan. Here are some of HUD's requirements:

- the new mortgage must be a refinance of an existing FHA-insured mortgage

- the maximum loan amount of the new FHA mortgage, including all the fees, closing costs, mortgage insurance premiums, must not exceed the oroiginal principal amount of the existing FHA mortgage. NOTE: if it does exceed the original principal balance, the borrower can provide cash to cover the difference.

- the new mortgage may not have a term of more than 12 years in excess of the unexpired term of the existing FHA mortgage.

- the new monthly payment must be less than the existing.

It appears that FHA to FHA refinances that are above the new loan limits do not have the same pressure as those who are planning on purchasng a home or refinancing a conventional loan to an FHA insured loan. If you're in that boat, you need to paddle quick as the clock is ticking down for those loan amounts with barely over 30 days remaining and some lenders implementing their own cut-off times in advance of HUDs.

If you're interested in an FHA loan anywhere in Washington State, I'm happy to help you. I've been originating FHA mortgages for the past 11 years at Mortgage Master Service Corporation where we have our own in-house underwriters.

Mind the Gap: High Balance Loan Amounts are Running Out of Time

Conforming and FHA high balance loan limits set to be reduced effective October 1, 2011. Banks and lenders have different cut-off dates in order to assure they're able to deliver loans without being stuck with a "jumbo" loan priced at a conforming rate.

Conforming and FHA high balance loan limits set to be reduced effective October 1, 2011. Banks and lenders have different cut-off dates in order to assure they're able to deliver loans without being stuck with a "jumbo" loan priced at a conforming rate.

If mortgage transactions are currently taking 30 days to close and mortgage companies are setting their own deadlines to make sure they can deliver before time runs out, borrowers need to act fast IF their loan amount is in the gap between the current and reduced limits. In King, Snohomish and Pierce Counties, loan amounts between $506,001 and $567,500 for single family dwellings will be impacted by reduced loan limits. This post I wrote a few weeks ago contains a complete list of reduced loan limits for conforming and FHA mortgages by county in Washington.

If you are refinancing or buying a home and your loan amount is "in the gap" between current and pending loan limits AND you're closing in late September, contact your mortgage originator as soon as possible to make sure that everything is in place so that your transaction closes in time (which may require closing prior to September 30 depending on your lender's guidelines). Be aware that you will most likely NOT be able to extend your rate lock commitments at the end of September if the loan amounts are in "the gap" range.

If you would like me to provide you a mortgage rate quote for your home located anywhere in Washington, click here.

Seattle Homebuyers Surprised by Multiple Offers on “Ideal” Homes

Earlier this month, Aubrey Cohen of the Seattle PI wrote "Home buyers finding competition for nice homes in Seattle". As a Mortgage Originator, I find that many of the home buyers that I'm working with are discovering it's taking a longer amount of time to find the "right home" due to lack of inventory and then, once they do find one they're interested in, they discover they're not alone. David Billings of Redfin, says:

"When the ideal, cute, turn-key starter home comes on market at a price that a buyer feels is a decent value, they're shocked to find that there are lots (three, four, maybe six) of other buyers that feel just like they do," …"After having patiently waited out the market and read every article about how terrible Seattle real estate is, they can't believe they'll need to pay full list price, let alone the possibility of paying more in order to beat out others. It takes some time for them to come to grips with this reality and get competitive with their offers, or adjust their search to a home that needs some work, or is in a slightly less prime location."

The article reports the "hottest" homes are priced under $500,000 "turn-key…staged, painted…" located in the neighborhoods of Northeast Seattle, Capitol Hill-Montlake and Ballard-Greenlake. "Multiple offers have jumped from between 30 and 35 percent to 40 and 50 percent, hitting 51.4 percent in Ballard".

What's a Ballard Home Buyer to Do? Actually, I think this applies to any home buyer who's considering making an offer on a home, especially if it's one that is "ideal" and newly listed.

- Meet with a local licensed Mortgage Originator to review your financial options and get preapproved. You really can't start this process too early – even if you're not planning on buying for a year, meeting with a mortgage originator and reviewing your credit and assets (funds for down payment) ahead of time may help put you in the best position possible for when your "ideal home" comes on the market.

- Have a plan and set your limits. Determine what mortgage payment you're comfortable paying and what down payment you're willing to part with (this may be a lower amount than what you're approved for).

- Develop thick skin. Buying a home can be emotional – especially in a bidding situation. Be prepared that you may not win a bid and stick to your price range.

- Work with a professional real estate agent. Get referrals and check out your real estate agent just as you would when selecting a mortgage professional. Some agents, especially in this market where their commissions may be down, may be more interested in making a sale than looking out for you. I'm happy share my recommendations with you.

- Be patient. Some of my clients have taken up to a year or more enduring several bidding wars before landing their home.

In a multiple offer situation, you're going to need to present yourself as a strong buyer, which includes having a well written preapproval letter. The Seller has probably heard plenty of horror stories of failed transactions due to tougher underwriting guidelines and they're going to want to select a strong buyer. Other factors may also include how quickly the transaction can close, especially if the home is vacant or if the seller has an offer pending on their next home.

In a possible bidding situation, I will often prepare several preapproval letters at various price points for my clients so they can determine just how high they want to go with the potential sales price.

With home prices in Washington reaching "record affordability" combined with historically low mortgage rates, many home buyers are looking for their "ideal home" at a more reasonable price or a distressed property at a discounted price.

Bottom line, be as prepared as possible and start the preapproval process early. If you're considering buying a home located anywhere in Washington State, I'd love to work with you.

Comcast service issues from Seattle to Renton

UPDATE 11:15 am: our office is being told that they expect service to be up in an hour.

UPDATE 11:00 am: learning that our office in Kent is having internet issues too. This sucks. No message from Comcast if the ETA is 1:45 today but that's how it's looking at this point! West Seattle Funblog reports that 388,000 Comcast users are NOT having a Comcastic experience.

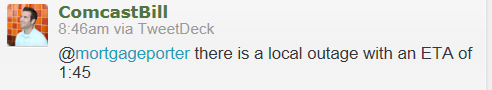

UPDATE 10:00 am: a few of us on Twitter are asking @ComcastBill if the outage is expected to be repaired in 1 hour and 45 minutes or at 1:45 today (no answer yet). My email is working – but slow.

UPDATE 9:30 am: It looks like Comcast's issues were spotty from the friends I surveyed on Facebook and Twitter. Regardless it looks like my service is slightly improved "back to normal"….KNOCK ON WOOD!! With so much of my mortgage business being internet based, having slow internet and email is a real set-back.

My internet and email are being painfully slow this morning. I tweeted to @Comcastcares and here's their response:

I'm trying to find out just how widespread this outage is.

Meanwhile I'm trying switching to my Droid to see if that will provide better service than Comcast.

Chasing Last Week’s Mortgage Rates | How Rates Change

Yesterday, a Seattle area homeowner I’ve been providing rate quotes to told me they’d like to lock if they could have the rate quote I provided him last week when mortgage rates were at an all time low. Six months ago, there would be a greater possibility that I would be able to offer her the same rate at the same price as last week prior to the Fed’s ruling on how mortgage originators are compensated (referred to as LO Comp).

LO Comp has done two things:

Using Rebate Pricing to Reduce Closing Cost on your Refi or Home Purchase

Mortgage rates are priced with rebate, a credit towards closing cost, or discount points, an additional cost paid to reduce the interest rate (Note rate). The amount of the rebate or discount is based on a percentage of the loan amount. The difference in pricing (rebate or credit) varies throughout the day, just as mortgage interest rates change. In fact, it’s not so much that the mortgage rates change throughout the day, it’s actually the cost or credit associated with that rate.

Recent Comments