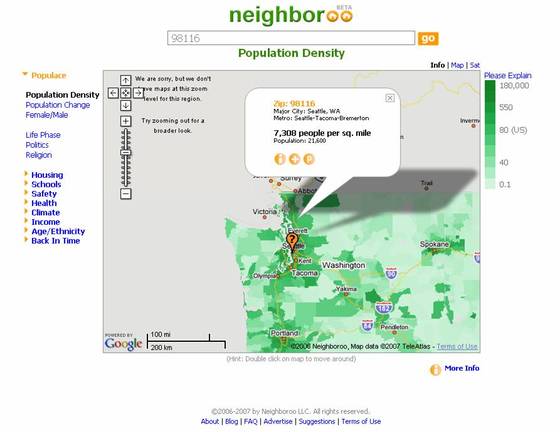

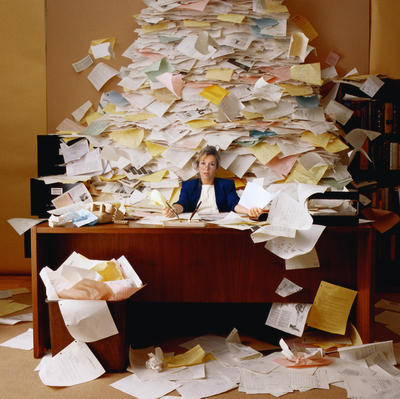

What will your career do to you? While watching the a.m. news, drinking my morning coffee…I came across this from Career Builders. Totally non-scientific. Click this to see my Valentine’s message to my husband.

Providing mortgage strategies IS NOT doing this to me…but blogging might be! Happy Friday everyone.

DFI has announced

DFI has announced

Recent Comments