I received this email from one of my readers:

"My mailbox is being bombarded with out of state Harp 2 "pre-approved" loan offers and I did call one of them and they talked me into running a credit report and when I found out their fees for the loan I didn't call them back and told them I had to think about it. I'm a not sure if this is a scam or not so I thought I would check locally…"

The Home Affordable Refinance Program (HARP aka HARP 2.0) has created a refi boom for mortgage originators. Many large banks are now telling their clients it may take up to three months to process their refinances due to the heavy volumes that are being experienced. Some banks have so much business that they're turning away clients just because they have private mortgage insurance or LPMI with their existing mortgage. NOTE: Our company is closing HARP loans and accepting HARP refinance applications with existing pmi and lpmi for properties located in Washington state.

HARP 2.0 has created a great opportunity for mortgage originators and companies to buy leads. I've always scratched my head at why a mortgage originator or mortgage company would have to buy leads. You have to wonder how their service is if they do not have enough business by clients who return to them for their HARP refinance. Especially if the company is out of state – is their business so bad they have to go out of state to find consumers who have never heard of them?

I would never work with a non-Washington based mortgage originator or company who has to buy leads in order to get a loan. However, should you decide to, please check the NMLS to make sure the company and mortgage originator are licensed to do business in Washington State. The solicitations you're receiving from these out-of-state lenders must disclose the license numbers for the company.

Google the company and the mortgage originator to learn more about them. Should you decide to proceed with someone you're about to spend several weeks with while your refinance is in process, you might want to check their credentials first.

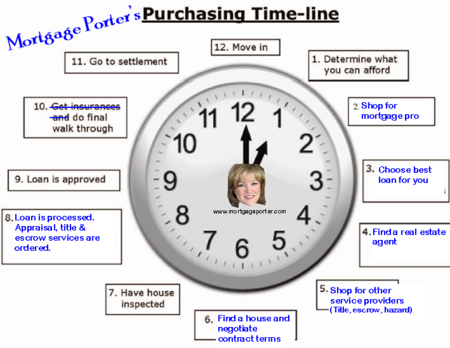

If you are considering buying or refinancing a home located anywhere in the state of Washington, I'm happy to help you. I've been originating mortgages at Mortgage Master Service Corporation since April 2000 and I've never paid for a "lead". My business is completely referral, returning clients and those who find me from reading my blog. Our local mortgage company located in King County has been family owned and operated since 1976.

Recent Comments