Effective on mortgage applications taken October 3, 2015 and later, lenders are required to use two new disclosures created by the CFPB. The Loan Estimate, which replaces the 2010 Good Faith Estimate and the RegZ/Truth in Lending; and the Closing Disclosure, which replaces the HUD-1 Settlement Statement.

Effective on mortgage applications taken October 3, 2015 and later, lenders are required to use two new disclosures created by the CFPB. The Loan Estimate, which replaces the 2010 Good Faith Estimate and the RegZ/Truth in Lending; and the Closing Disclosure, which replaces the HUD-1 Settlement Statement.

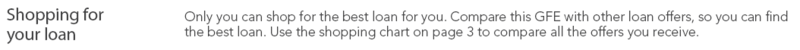

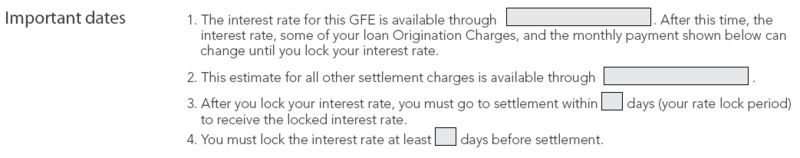

The new disclosures, the Loan Estimate and the Closing Disclosure, have “wait periods” that restrict how soon a real estate transaction with a mortgage can close. The Loan Estimate is issued once a lender has received an application (the six points of information that creates an application per the CFPB) within three business days. There is a seven day waiting period that takes place once the Loan Estimate has been delivered before the borrower can sign their final loan documents (also referred to as “consummation”).

Recent Comments