Earlier this week, it was revealed that over 100,000 tax payers may have had their personal information stolen from the IRS. This data breach is potentially causing hiccups with real estate transactions currently in process too.

Earlier this week, it was revealed that over 100,000 tax payers may have had their personal information stolen from the IRS. This data breach is potentially causing hiccups with real estate transactions currently in process too.

IRS breach potentially delaying real estate transactions

Mortgage Insurance Tax Deduction extended through 2013

With the recent passage of the American Tax Payer Relief Act of 2012, Congress extended the ability to deduct mortgage insurance the same as qualified residence mortgage interest. This applies to homes with private mortgage insurance, FHA mortgage insurance (upfront and monthly) as well as VA and USDA funding fees.

A qualified home, as described by the IRS, is your primary residence or your second home. You cannot collect rent on your second home or it’s…. (are you ready for this?) an investment property and not eligible for this deduction.

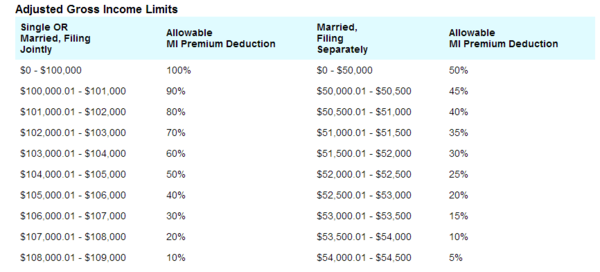

This benefit is phased out for adjusted gross incomes over $100,000. Here is a chart compliments of MGIC regarding how much one may be able to deduct based on AGI:

The amount of mortgage insurance paid is disclosed on the Form 1098, along with the mortgage interest that was paid during that year.

For more information, please contact your personal CPA or tax professional. I am not a CPA, I am a Licensed Mortgage Originator for homes located in Washington state. If I can help you with your mortgage needs for your home located in anywhere in Washington, including Seattle, Sequim or Snoqualime, please contact me.

Recent Comments