Mortgage originators (also referred to as Loan Officers or MLOs) are required to be licensed with the NMLS unless they work for a depository bank or credit union, in which case they are only required to be “registered” (per the SAFE Act).

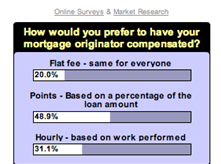

Poll Results: How Would You Like Your Mortgage Originator Compensated?

Our poll is over and I’m actually a little surprised by the results: a majority prefers the current most common form of mortgage originator compensation.

Points, based on a percentage of the loan amount received 48.9% of the vote. Followed by hourly, based on work performed, at 31.1%. Paying your mortgage originator a flat fee, the same fee for everyone, came in last at 20%.

I hope the FED and Washington State’s DFI reads this… right now they’re both trying to change how mortgage originators are paid.

Shouldn’t it be up to the consumer? They have the right to vote with their feet. If they don’t like how a mortgage originator feels they should be compensated, they can walk.

Our government getting involved with how an industry is paid is very troubling to me.

Your thoughts?

Washington Correpsondent Lenders are forced to have Consumer Loan License

Today’s Mortgage Brokers Commission meeting was attended by many concerned mortgage brokers and correspondent lenders (brokers with warehouse lines of credit) who feel as though they’ve had a real doozy pulled over them by recent legislation, specifically SB 6471. Deb Bortner of DFI (bad photo compliments of my Treo) insists that it was not DFI’s intentions to rope in the correspondent lenders who are licensed as mortgage brokers to be regulated by the Consumer Loan Act.

Today’s Mortgage Brokers Commission meeting was attended by many concerned mortgage brokers and correspondent lenders (brokers with warehouse lines of credit) who feel as though they’ve had a real doozy pulled over them by recent legislation, specifically SB 6471. Deb Bortner of DFI (bad photo compliments of my Treo) insists that it was not DFI’s intentions to rope in the correspondent lenders who are licensed as mortgage brokers to be regulated by the Consumer Loan Act.

Many Washington State correspondent lenders (and we, loan originators who work for a correspondent lender) are feeling very frustrated (to sugar coat it). A majority of us have abided by the State’s licensing laws, paid our dues, passed our background checks and the exam…even if we were not a “true” broker. We played along and played by the rules. In an attempt to “capture” a few Correspondents who apparently do not broker (they’re direct endorsed lenders, like Mortgage Master, except we will broker a small portion of our loans), who were exempt from the Mortgage Brokers Practice Act, the State decided to deem any mortgage broker with a warehouse line (i.e. Correspondent Lenders) will now be regulated under the Consumer Loan Act. Correspondent Lenders can retain both licenses and be held liable accountable under both acts, or just maintain their newly required Consumer Loan License. There’s significant expenses for both licenses which I may or may not get into in a future post.

After Deb Bortner defended DFI’s position, she handed the floor over to the audience and here’s a few of the comments from “the floor” of brokers that I found interesting (I’m paraphrasing, since I was not able to write fast enough and I’m not quoting the individual broker):

“This [obtaining a consumer loan license] goes against every value we have in our business. We can now hire felons, are no longer required to do continue education and the consumer will pay. What you’re doing is STUPID.”

“This is a nasty little bill with nasty little consequences.”

“We are Correspondent Lenders. We are different than Mortgage Brokers and we are NOT a Pawn Shop.”

“I wish the media was here to see all of these mortgage brokers fighting for the consumer.”

“For half of the mortgage industry to have to go through the licensing again is crazy.”

“Everyday that goes by is less chance of closing a loan. We [correspondent lenders] have the ability to draw docs and close loans quicker and more efficiently than true mortgage brokers.”

“How many lenders were actually not licensed through the loophole? It seems the motivation here is more taxes.”

“What is DFI going to do with all the extra money?”

Mortgage Brokers and Correspondent Lenders, your next chance to hear what DFI has to say is next week in Bellevue on Tuesday, May 13–however you must RSVP by this Friday, May 9, 2008. For more information, click here. As of midnight, June 11, 2008, if you have a warehouse line of credit and you’re a mortgage broker or correspondent lender, you need a Consumer Loan License.

Recent Comments