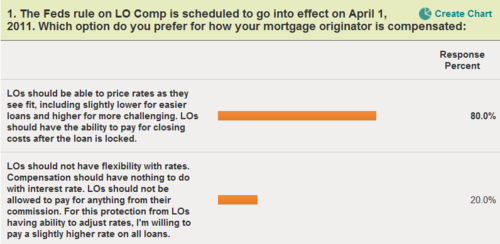

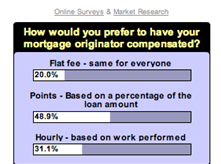

A few weeks ago, I posted a survey with three questions to learn consumers opinion about the Fed's rule on loan originator compensation and how they select their loan originator. Here are the results.

Please rate the following based on how you will select your next mortgage professional:

- Years of experience as a mortgage originator (72.7%)

- Referral from someone you trust (63.6%)

- I will return to the LO who helped me with my last mortgage (62.8%)

- Whoever quotes the lowest rate (45.5%)

- Type of institution (bank, correspondent lender, broker or credit union). (38.6%)

When I'm helping someone with a mortgage for a home located in Washington state, I find that a majority of my new clients are readers of my blog. I'm also fortunate that many of my clients are referred to me from real estate agents and financial planners. Home owners I have helped in the past also tend to refer their friends and family and return to me for their next. I do not advertise (with the exception of my tiny ad on West Seattle Blog), I do not take "up calls" and I do not buy leads…never will.

Thank you for reading my blog and for remembering me when you or someone you know needs a mortgage for a home in Washington. I feel so fortunate to have my business model where consumers seek my professional advice and assistance with their home loans.

Recent Comments