Ardell, Jillayne and yours truly will at Crossroads in Bellevue at 6:30 pm on February 4, 2009. I’m bummed that Dustin can’t make it (maybe he’ll suprise us). And so far, fellow authors, Craig and Robbie, say they’ll be there too!

It’s a causal meet-up that Ardell is organizing. We’d love to meet our readers, commenters and fellow contributors. For more information or to give us a heads up that you’re stopping by.

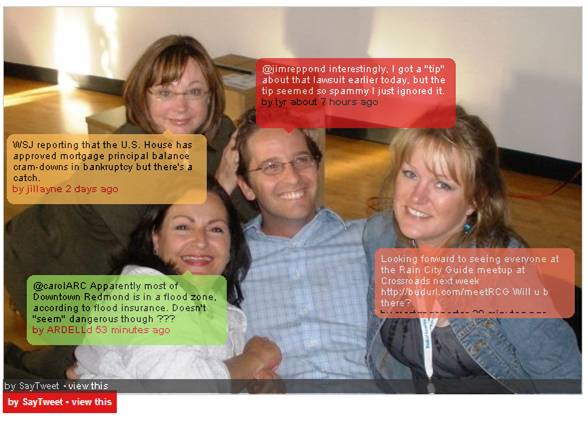

By the way, if you visit Rain City Guide’s About RCG page, you’ll see what the four of us are twittering–just like the photo above which was taken at Inman Connect in San Francisco last summer. Sadly, RCG contributors rarely have the opportunity to pile on a bean bag chair together.

Recent Comments