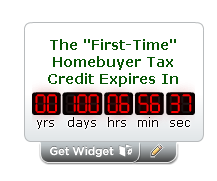

My apologies for the home buyer tax credit clock I've added to the left side bar of my blog ticking away the time remaining for home buyers tax credit. It's not my style, I don't like to pressure folks and I really don't like telling someone that they missed an opportunity.

My apologies for the home buyer tax credit clock I've added to the left side bar of my blog ticking away the time remaining for home buyers tax credit. It's not my style, I don't like to pressure folks and I really don't like telling someone that they missed an opportunity.

Whether you are for or against our home buyer tax credit it is something that many home buyers, first time and "move-up" home buyers, will take advantage of. Unlike the first tax credit that was passed where the home buyer had to pay it back over 15 years, this is a "tax credit". This credit repaid if you sell your home within three years.

The available tax credit for first time home buyers (those who have not owned a home in the last 36 months) is up to $8,000. For the "move-up" or "long-time resident" (you don't have to be buying a bigger home to qualify), the available tax credit is up $6,500. The long-time resident is defined as someone who has owned their home as their primary residence for the last three out of five consecutive years. The tax credit for both first time and long time residents is for the purchase of a primary residence (owner occupied).

Income limits were raised for transactions closing after November 6, 2009 to up to $125,000 modified adjusted gross income (MAGI) for taxpayers and $225,000 for joint filers. The credit is reduced up to those with MAGI above $145,000 for single and $245,000 for joint.

Homes with a sales price of over $800,000 are not eligible (too bad–the Jumbo market needs all the help it can get).

In order to qualify for the tax credit, home buyers must be in contract to purchase a home by April 30, 2010 (100 days away as of today)* with a closing date no later than June 30, 2010 (no summer vacations for escrow officers in June). Home buyers will need to file IRS Form 5405 and be sure to include a copy of their HUD-1 Settlement Statement.

Members of our Armed Forces serving outside of the United States have been granted an extra year for the tax credit. They must be in contract by April 30, 2011 and close prior to June 30, 2011.

Check with your tax advisor for more information.

Special note: this is my 1000th article posted at Mortgage Porter! Thanks again for your continued support and readership.