President Obama is seeking public input on financial reform. Let me get this off my chest right now: I WISH OUR GOVERNMENT WOULD START WITH CAMPAIGN REFORM FIRST. I don't how any other reform can truly effectively take place without the influence of lobbyist in our government…how can they truly represent the people and how can they have any credibility if they don't walk the reform talk?

Anyhow, here are the questions with my answers. You can visit the website that even comes with equipped with a "Decoder" button which is really a glossary of terms. Your answers need to be submitted in writing–more details are on President Obama's site www.financialstability.gov.

The Obama Administration will seek input in two ways. First, the public will have the opportunity to submit written responses to the questions published in the Federal Register online at www.regulations.gov. Second, the Administration intends to hold a series of public forums across the country on housing finance reform.

Questions for Public Solicitation of Input:

- How should federal housing finance objectives be prioritized in the context of the broader objectives of housing policy?

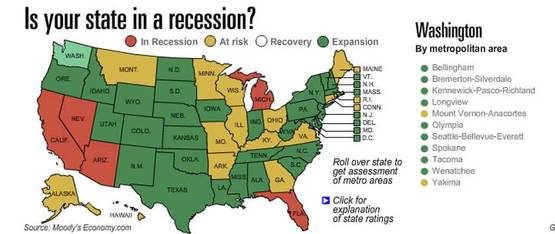

- What role should the federal government play in supporting a stable, well-functioning housing finance system and what risks, if any, should the federal government bear in meeting its housing finance objectives?

- Should the government approach differ across different segments of the market, and if so, how?

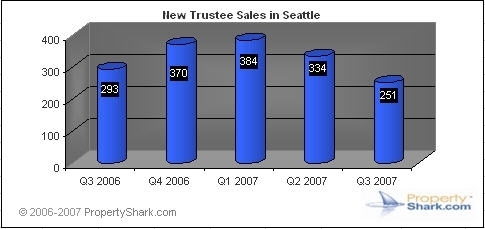

- How should the current organization of the housing finance system be improved?

- How should the housing finance system support sound market practices?

- What is the best way for the housing finance system to help ensure consumers are protected from unfair, abusive or deceptive practices?

- Do housing finance systems in other countries offer insights that can help inform US reform choices?

What would you like to see the Government to do with regards to home financing? We havethe SAFE Act, which effectively creates two classes of mortgage originators: licensed and registered (unlicensed). My biggest concern with Financial Reform, without Campaign Reform, is that the end result may be that Americans have even fewer choices for their home financing. Not just originators or types of institutions to chose from, I'm talking about products too.

Your thoughts?

Recent Comments