Sometimes the information shown on tax records may not be what a person will actually pay for their property taxes. This is common with new construction or if the property is currently qualified for an exemption, such as for a Senior Citizen.

Right now I’m working on a estimate for a newly built home. King County records are showing the property taxes at $1,810 for 2008 on a home that has an assessed value for 2009 of $917,000. This is obviously not accurate (or it’s one heck of a sweet deal). I found this information via my preferred title company’s website. You can also find this by visiting King County’s website.

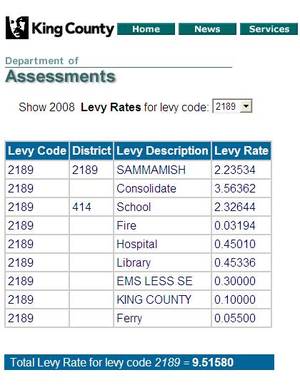

To determine a better picture of what the taxes will be you’ll need to know assessed value and what the Levy Rate is for that property.

The assessed value of this property is currently $917,000 and the levy rate is 9.51580. This means that homes within this levy code are taxed $9.5158 per every $1,000 of assessed value. For this specific property: 917 x 9.5158 = $8,725.99.

You can see there’s quite a difference between $8,725 and $1,810 what is currently being reported. Their real estate taxes are going to go up at least $7,000 (not including what happens after the tax assessor decides the home is worth more–always plan on your mortgage payment adjusting due to your taxes and insurance–which are not fixed). In this case, the taxes shown are based on the land and not the improvements (the newly built home). However, the home buyer would be responsible for “back taxes” or omit taxes if they would have relied on the lower tax amount.

Omit taxes can be a nasty surprise to someone who has purchased a new construction home–this is why it’s so important to make sure your tax information is as accurate as possible.

Typically, without actual tax information, we will use 1.25% of the sales price to estimate property taxes. Hopefully we’re estimating on the high side and in reality, your taxes are more palatable, as in this case.

If I can help you with your home purchase or refinance for your home located anywhere in Washington state, please contact me!

Discover more from The Mortgage Porter

Subscribe to get the latest posts sent to your email.

Please leave a reply