This morning the August Jobs Report came in with slightly weaker data than expected with only 151k non-farm payroll jobs added.

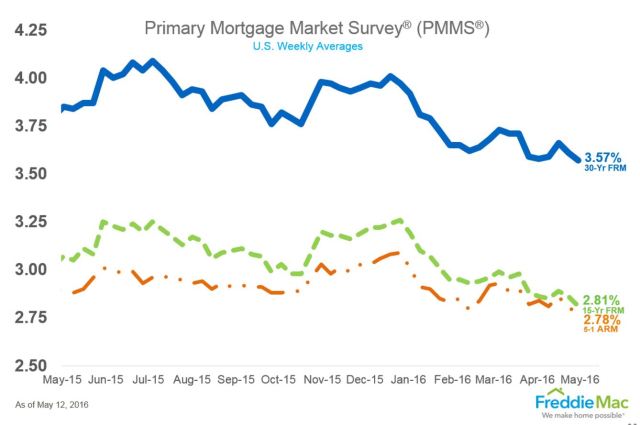

Yesterday, Freddie Mac released their PMMS report showing the 30 year fixed conventional rate still hanging around (just below) 3.500%.

If you’ve been contemplating refinancing, it could be time to get off your duff! If your home is located anywhere in Washington state, I’m happy to help you. Click here for a no-hassle mortgage rate quote.

PS: Our office will be closed on Monday for Labor Day. I hope you have a wonderful holiday weekend!

The morning the Jobs Report was released with weaker than expected data with only 38K non-farm jobs added in May. This is far less than the anticipated 155k jobs. In addition, April’s Jobs Report was revised with fewer jobs than originally reported.

The morning the Jobs Report was released with weaker than expected data with only 38K non-farm jobs added in May. This is far less than the anticipated 155k jobs. In addition, April’s Jobs Report was revised with fewer jobs than originally reported.

Recent Comments