I'm working with a couple in Seattle who are looking at refinancing their current adjustable rate mortgage to a 30 year fixed. Their proposed amount will be about $560,000 for a conforming high balance mortgage. If they wait too long to start the refinance process, this transaction will not be eligible to be a conforming high balance mortgage as the loan limits in King County are dropping to $506,000. Although Fannie Mae states the roll-back in conforming loan limits is based on Notes dated prior to October 1, 2011, lenders will implement their own deadlines well in advance in order to avoid being caught holding a mortgage they can no longer sale as conforming.

I'm working with a couple in Seattle who are looking at refinancing their current adjustable rate mortgage to a 30 year fixed. Their proposed amount will be about $560,000 for a conforming high balance mortgage. If they wait too long to start the refinance process, this transaction will not be eligible to be a conforming high balance mortgage as the loan limits in King County are dropping to $506,000. Although Fannie Mae states the roll-back in conforming loan limits is based on Notes dated prior to October 1, 2011, lenders will implement their own deadlines well in advance in order to avoid being caught holding a mortgage they can no longer sale as conforming.

I know I've been writing about the pending deadlines a lot…whether or not you are for or against the reduction in loan limits, in my opinion, this will dramatically impact area home owners.

What's the difference between jumbo (non-conforming) and conforming high balance mortgages?

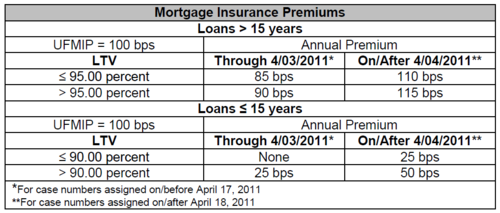

- Mortgage rates for fixed jumbo products are about 0.5% higher. A higher rate equates to a higher mortgage payment which of course means it's tougher to qualify for.

- Most jumbo loans require a low-mid credit score of 720 or higher. If a spouse has a mid-credit score of 719 or lower, and nothing can be done to rescore, you may not qualify for a jumbo loan.

- Most jumbo loans have a maximum loan to value of 80%. Some of our lenders will go up to 85% using a second mortgage, however they require a 720 or higher credit score.

- Jumbos tend to require the borrower has more assets in reserves than a conforming high balance mortgage.

Remember, it's not just conforming high balance loan limits that are dropping in a few weeks, FHA loan limits are too.

Many home owners who do not start the refinance process now are going to discover they no longer qualify for a refinance or the rate is not as attractive to where it makes sense. Some who do qualify may wind up considering an adjustable rate jumbo in order to have an improved rate for a fixed period of time.

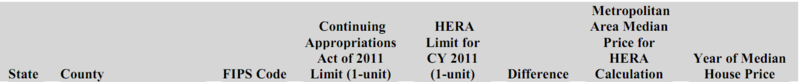

What loan amounts are soon going to be classified as a "jumbo"? It depends on which county in Washington your home is located in:

King, Pierce and Snohomish Counties:

- Conventional loan amounts between $506,001 and $567,500.

- FHA loan amounts between $506,001 and $567,500.

Kitsap County:

- Conventional loan amounts between $417,001 and $475,000.

- FHA loan amounts between $307,050 and $475,000.

Jefferson County:

- Conventional loan amounts between $417,001 and 437,500.

- FHA loan limits between $322,001 and $437,500.

San Juan County:

- Conventional loan amounts between $483,001 and $593,750.

- FHA loan amounts between $483,001 and $593,750.

Clark and Skamania Counties:

- Conventional loan amounts between $417,001 and $418,750.

- FHA loan amounts between $362,251 and $418,750.Jefferson County

The following counties do not have "high balance conforming" loan limits. They will be seeing adjustments in FHA loan limits and have a short window to take advantage of these loan amounts:

Benton and Franklin Counties: FHA loan limits between $271,051 and $275,000.

Island County: FHA loan limits between $316,251 and $381,250.

Kittitas County: FHA loan limits between $271,051 and $328,750.

Mason County: FHA loan limits between $271,051 and $310,000.

Skagit County: FHA loan limits between $295,551 and $373,750.

Thurston County: FHA loan limits between $293,251 and $361,250.

Whatcom County: FHA loan limits between $304,751 and $375,000.

If you're considering a mortgage with a loan amounts addressed in this post in any of these Washington counties, please don't delay your refinance or you may not be able to take advantage of the benefits that conforming or FHA loans provide (better rates and easier underwriting guidelines). Fannie Mae has indicated that we may see loan limits further reduced effective 2012 (we won't have more information until around November of this year).

If you are in contract to purchase a home and potentially have a "future jumbo" loan amount (listed above), please contact your loan officer immediately to make sure you're closing in time or make sure that you qualify for a non-conforming mortgage if your closing date is beyond the deadline.

Please forward this post onto any of your friends, family or co-workers who may be impacted with the reduced loan amounts. I'm happy to help anyone who needs a mortgage for a home located in Washington state.

UPDATE August 19, 2011: HUD has announced that FHA to FHA refinances may exceed the new lower loan amounts if the refi meets certain requirements.

Recent Comments