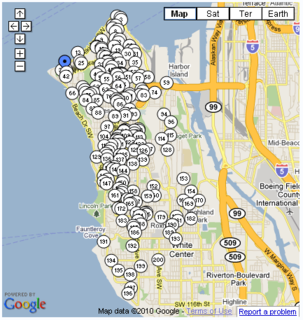

If you love rumaging through garage sales, you’re in for a treat. The West Seattle Blog has organized the 6th annual West Seattle Community Garage Sale with about 200 homes participating. Click the map for a updated printable version.

If you love rumaging through garage sales, you’re in for a treat. The West Seattle Blog has organized the 6th annual West Seattle Community Garage Sale with about 200 homes participating. Click the map for a updated printable version.

They couldn’t have picked a nicer day for the sale with sunny skies and temps in the upper 60s.

This event is today only, May 8, 2010, from 9:00 am to 3:00 pm. Come on out to West Seattle, visit the garage sales and stick your toes in the Puget Sound along Alki. Have a great day!