Recently I talked with a Seattle home owner who's considering refinancing their 30 year fixed rate mortgage for an adjustable rate mortgage. Adjustable rate mortgages (ARMs) have fallen out of favor in recent years due to the mortgage melt-down. I've never been a fan of option ARMs, however there is nothing wrong with adjustable rate mortgages as long as the borrower understands the terms and it's suitable for that person's financial scenario. This home owner's financial plan is to be mortgage free in seven to ten years after his children are out of college. Cash flow is important right now so he would rather not do a 10 or 15 year amortized mortgage.

You very well could be scratching your head right now thinking "with how low fixed rates are right now, why on earth would anyone consider an ARM?"

With his scenario, we're looking at a loan amount of $400,000 and a loan to value of 60% with excellent credit (scores are above 740). I priced the following scenarios with zero points (origination or discount). These rates are effective as of 5:00 p.m. December 15, 2010.

4.875% for a 30 year fixed (APR 5.020). Principal and interest payment (P&I) = $2,117. With this scenario, your principal and interest payment is never scheduled to change.

4.375% for a 10/1 ARM 12 month LIBOR with 5/2/5 CAPS 2.25 Margin (APR 5.731). P&I = $1997. With this scenario, after 120 payments (10 years) the rate will adjust based on adding the 1 year (12 month) LIBOR is plus the 2.25 margin limited by the first "cap" of 5%. The rate in 120 months cannot be higher than 9.375% nor lower than 2.25% (the margin also acts as "the floor" limiting how low the rate can adjust). After the first adjustment, the rate will adjust once a year on that anniversary of the first adjustment limited by 2% up or down. The highest the rate can be on this scenario during the lifetime of this loan is 9.375%.

3.625% for a 7/1 ARM 12 month LIBOR with 5/2/5 CAPS 2.25 Margin (APR 5.742). P&I = $1824. With this scenario, after 84 payments (7 years) the rate will adjust based on adding the 1 year (12 month) LIBOR p the 2.25 margin limited by the first "cap" of 5%. After 84 payments/months, the rate cannot go higher than 8.625% or lower than 2.25% (the margin/floor). After the first adjustment the most the rate can adjust annually is 2% up or down following 12 the anniversary of the first adjustment (at 96 months) and annually thereafter. For example, worse case at the second adjustment (96 months) the rate could be 10.625% (3.625% plus 5% at 7 years and plus an additional 2% at 8 years).

Selecting a 30 year fixed mortgage provides security of a fixed and options with your mortgage payment. The home owner can pay additonal towards principal to pay down the mortgage. A 15 year fixed mortgage is also more "safe" than an adjustable if you're concerned about retaining the mortgage beyond the ARM's fixed period. However there is no flexibility with the payment (you can make a 15 year payment on a 30 year mortgage; you cannot make the 30 year payment on the 15). I'll admit I'm biased towards the 30 year fixed mortgage, however Americans currently still has a choice as to what mortgage options they prefer unless Congress changes this (as I'm afraid they'd like to).

Adjustable Rate Mortgages will reamortize based on the remaining term at their adjustment points. For example, after 120 payments with a 10/1 ARM, the payment will be based on the new rate and a 20 year amortization. With a 7/1 ARM, the payment will be based on the new rate and a 23 year amortization (7 years minus 30 years).

My client is actually considering an ARM because of the amount saved in monthly payments over the term he plans on retaining his mortgage.

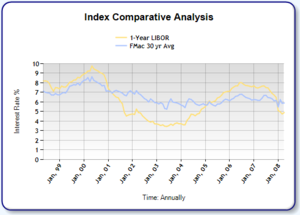

Let's compare the ARMs and 30 year fixed scenarios at 84 months…of course, there is no way for us to know what the LIBOR rate will be 7 years from now to predict an 100% accurate rate.

30 Year Fixed Rate at 7 Years. Principal Balance = $350,879. P&I=$2,117. No change.

7/1 ARM at 7 Years. Principal Balance = $341,250 providing a principal savings of $9,629 over the 30 year fixed rate. The difference in payment between the 30 year and 7/1 ARM over this time period is $24,612 (2117 – 1824 = 293 per month. 293 x 84 = 24,612. However…the payment is set to adjust. Worse case scenario, the rate could go up to 8.625%. Amoritzing $341,250 at 8.625% for 23 years provides a principal and interest payment of $2,156 – worse case scenario, this is only $39 more a month than what the 30 year fixed scenario has been paying the full 7 years.

10/1 ARM at 10 Years has a principal balance remaining of $347,156. The payment is $120 less per month than the 30 year fixed providing a monthly payment savings of $10,080. And the 10/1 ARM will continue to have a fixed payment 3 years beyond the 7/1 ARM; at 7 years, the rate for the 10 year ARM is still 4.375% with the same principal and interest payment of $1997 where the 7/1 ARM payment at 85 months is unknown.

Bottom line, it's important to review your options and to consider your personal life plans. A 30 year fixed rate mortgage if you're not planning on retaining that financing or home more than 10 years may be costly–however if you cannot stomach the thought of your rate ever adjusting, the 30 year fixed rate may be your cup of tea. It is (and should remain) the homeowner's choice.

Recent Comments