12/10/11 EDITORS NOTE: Like many mortgage programs, some of the guidelines and features to USDA loans have changed since the original publishing of this post. This is a good thing to keep in mind whenever researching mortgages on-line.

USDA Guaranteed Rural Housing loans are administered through the USDA to provide financing in areas that are designated as “rural” for families under certain income limits. Qualified borrowers can purchase a home in a USDA approved area with 100% financing and if the appraised value is higher than the sales price, the home buyer can actually finance their closing costs too (USDA will consider the higher of the two). It’s a pretty sweet deal for the right home buyer.

Program highlights:

- 103.5% financing based on the appraised value

- 30 year fixed rates with government pricing

- No monthly mortgage insurance. There is a one-time guarantee fee (similar to a VA funding fee or FHA upfront MIP) of 3.5% which is financed into the new loan.

- No down payment or first time home buyer requirements

- 29/41 debt-to-income ratios (exceptions available with compensating factors)

- Closing costs may be financed into the new USDA mortgage (based on appraised value).

- Seller contributions allowed for all closing costs and prepaids

- Gifts from disinterested third parties allowed

- Primary residence (owner occupied) only

- Home buyer may not own other adequate housing

- Single family dwellings or HUD approved condos

- Subject to household income limits. Currently (5/6/11) in King County and Snohomish County, the income limits for a 1-4 person household is $92,600 and 5-8 person household is $122,250.

- No loan limits (income limits factored with debt-to-income ratios will create a loan limit for each specific scenario).

- Escrow hold backs for repairs allowed up to the lower of 10% of the loan amount or $10,000.

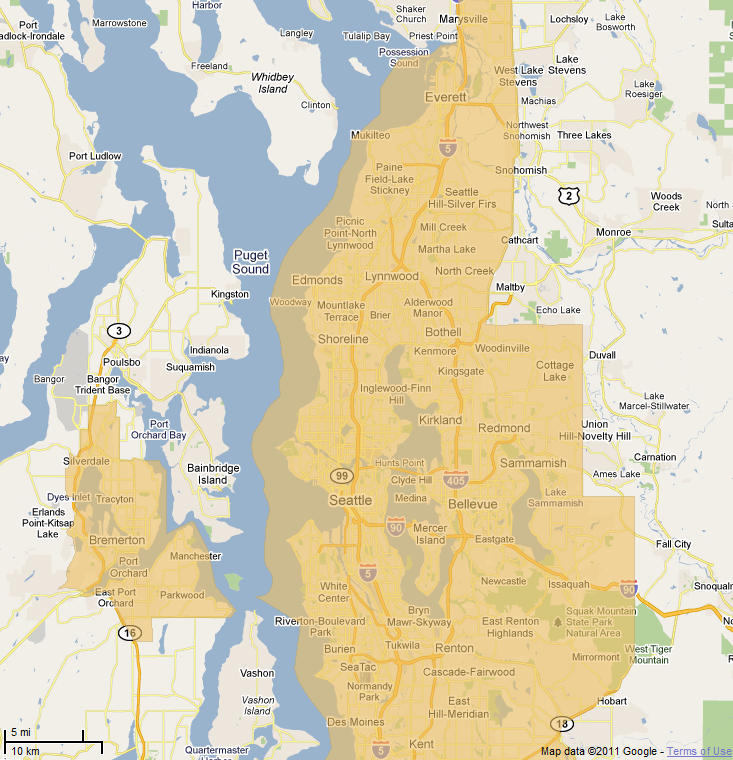

As I write this post, a majority of Washington State qualifies for this government backed program, including Bonney Lake/Lake Tapps, Enumclaw, parts of Maple Valley, North Bend, Duvall, Bainbridge Island, Vashon Island and Gig Harbor. Click here to see if a specific property is eligible.

EDITORS NOTE: Rates posted below have been EXPIRED for YEARS!!! Please click here for a current mortgage interest rate quote.

Let’s compare FHA and USDA financing to would look like for a qualified home in Fall City with a sales price of $350,000 utilizing a 30 year fixed rate with 720 mid-credit scores and with the seller paying closing costs and prepaids:

USDA

- Current rate: 4.375% (APR 4.820)

- Mortgage payment (excluding property taxes & home owners insurance): $1,808.66

- Down payment required: $0

FHA

- Current rate: 4.250% (APR 5.189)

- Mortgage payment (excluding property taxes & home owners insurance): $1,999.34

- Down payment required: 3.5% = $12,250 (may be gifted by family member)

The USDA mortgage payment payment is $190.68 less per month and cash needed for down payment is $12,250 less than the FHA scenario.

If you are considering buying a home located in a rural community that qualifies, USDA financing could be a prime choice!

If you would like more information about buying or refinancing your home located anywhere in Washington, please contact me. I’m happy to help!

NOTE: areas below that are not orange are currently eligible for USDA financing!

Discover more from The Mortgage Porter

Subscribe to get the latest posts sent to your email.

Is this program still available?

Yes, Lynda, it is!

Trying to buy land on Camano Island. We live and work in Hawaii. Land loan would be paid off from income here, then we move and build. That’s the plan anyway 🙂 Any land loan with an LTV greater than 75%? It’s funny to think that I can buy two $40,000 cars, but not an $80,000 piece if land.

Hi Brent, we don’t do land loans. Sorry! You might want to check with Washington Federal.