Previously I reviewed HUD's Home Purchasing Time Line, which I found several issues with if you're a home buyer in Washington State. If I'm going to pick something apart, it's only right that I offer an example of how I think it should be corrected.

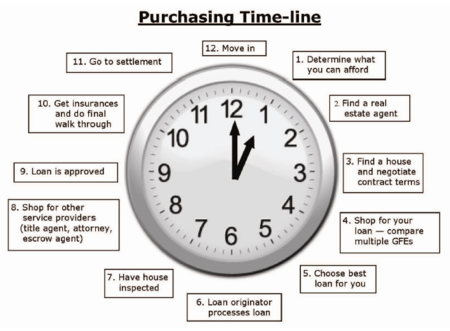

Below is HUD's suggested time line.

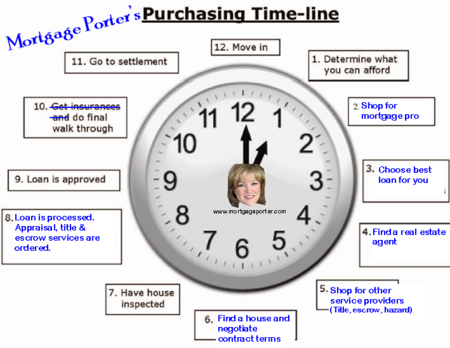

Here is how I see a successful purchase transaction evolving. My modifications to HUD's time line are in blue below.

Rhonda Porter's Ideal Home Purchase Time Line

Step 1: Determine what you can afford. Make sure you really consider how much home you can personally afford (not just how much home you qualify for or what a lender tells you). Please do not stretch yourself to be "house poor". Keep in mind the lessons that this economy is teaching all of us.

Step 2: Shop for a mortgage pro. Oh how I wish that instead of a shopping cart for rates (which is a moving target) and fees on page 3 of the new Good Faith Estimate, that it had a place for you to "shop" your mortgage professional instead. Perhaps a place where you could compare resumes and available products instead of focusing so much on rate and fee. The person who will be guiding through the process of obtaining one of the largest debts you may have in your lifetime should not be selected so casually.

Step 3: Choose the best loan for you. After selecting your mortgage professional; he or she should consider your financial goals and help provide you with information to allow you to make an educated decision on which mortgage program best suits your goals based on what you currently qualify for. You need to know what your total payment will be and how much money will be required for your down payment and closing costs BEFORE you start looking for your next home.

Step 4: Find a real estate agent. I recommend asking friends and family members who have recently purchased or sold a home and interview them. If you need a recommendation for one around the greater Seattle area, please ask me!

Step 5: Shop for other service providers. This has to happen BEFORE you prepare an offer on your next home assuming your lender permits you to shop (this is per RESPA guidelines–not a control freak mortgage originator). If you select your own title and escrow service provider, there is no cap to how much their fees can change at closing. If you use the providers from the mortgage originators preferred list, the accumulative fees at closing cannot exceed 10% from the good faith estimate.

Step 6: Find a home and negotiate contract terms. Now you can start searching for your next home with confidence since you know what you can afford and you have your home buying team assembled.

Step 7: Have house inspected. I recommend this even if your home is new construction. I can tell you a few stories…but this post is all ready getting too long!

Step 7.5: Shop and select your home owner insurance provider. Do not wait until closing to do this. Home owners insurance rates can vary and your credit score will impact your insurance rate. Also if the home has a history with certain insurance claims, there could potentially be issues that are better to be aware of early in the process.

Step 8: Loan is processed. Once we have a signed around agreement, your loan is processed and various services are ordered or set up. This is also the time to review you lock options to determine whether you want to commit to an interest rate or float (not lock).

Step 9: Loan is approved. The loan approval may come back with conditions. This happens after the underwriter reviews what has been submitted to them during the processing period.

Step 10: Do the final walk through.

Step 11: Go to settlement. Prior to your escrow appointment, I recommend that you obtain a copy of your estimated HUD-1 Settlement Statement 1-2 days in advance so that you have time to review the final figures. Be sure to let your mortgage professional and escrow officer/settlement agent know that you expect this as the lender will need to provide your loan documents to the closing company a few days earlier than "the norm". The same is true if you want a complete copy of your loan documents to review prior to your signing appointment.

Step 12: Move in! Yay–this can be such an exciting time! Typically there may be a few days between signing your closing documents and moving into your new home.

Here is why I like when they talk to me before a lender, because I have had a real problem with buyers losing earnest money and deals because lenders cannot get deals closed on time.

Your system may work for you, because you can, but if a buyer comes to me and already has a lender I make them sign a form that says they understand the risk of using an unproven lender and if the lender is unable to perform then I am not responsible. I will do everything I can to work with that lender for a successful transaction, but I am not responsible for that lender.

When they come to me first I can give them a list of three lenders who all have in house underwriting and can get deals closed in 30 days or less.

Dean, that’s why I stress selecting a mortgage professional in step #2. This doesn’t mean finding the person who’s publishing the lowest rates on the internet or newspaper–home buyers need to connect with a mortgage professional who’s qualified, experienced and has the proper resources to be able to assist them with balancing what they can afford for their budget with the proper mortgage vehicle that will best suit their financial goals.

Nothing’s worse than to have a buyer start looking at homes they cannot afford and then meet with a mortgage pro. Often times, emotions take over and they may be more willing to try to finance their “dream home” with at any means possible…instead of starting with the budget and then looking for what they can afford.

So we agree 100%, but the problem I see is borrowers have no idea how to tell one from another. It is so often I have a client who says I am pre-approved, they tell me they are pre-approved with big bank x, y or z, at that time I usually warn them that x y or z may not be able to close quick enough and they could be facing a perdiem on the foreclosures. They still insist on staying with the big bank OR staying with their brothers friends.

So the problem is it needs to be more widespread on who can get loans closed and who has trouble. That is the hard part, getting the client educated in the way they should be.