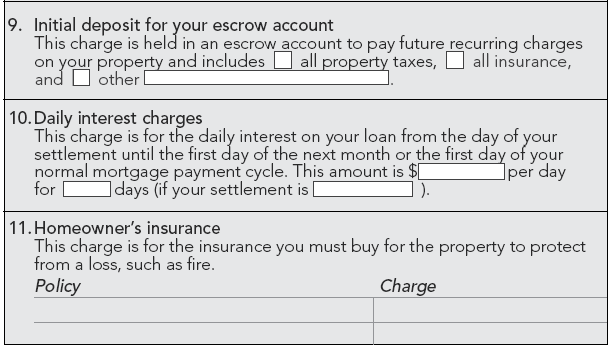

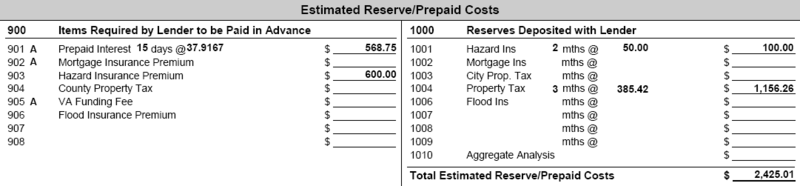

This is the last page of HUD's new Good Faith Estimate should hopefully be pretty self-explanatory…although it is new concept as compared to the GFE that we have been using.

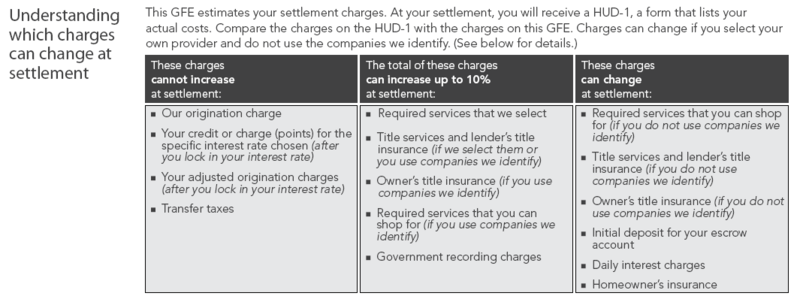

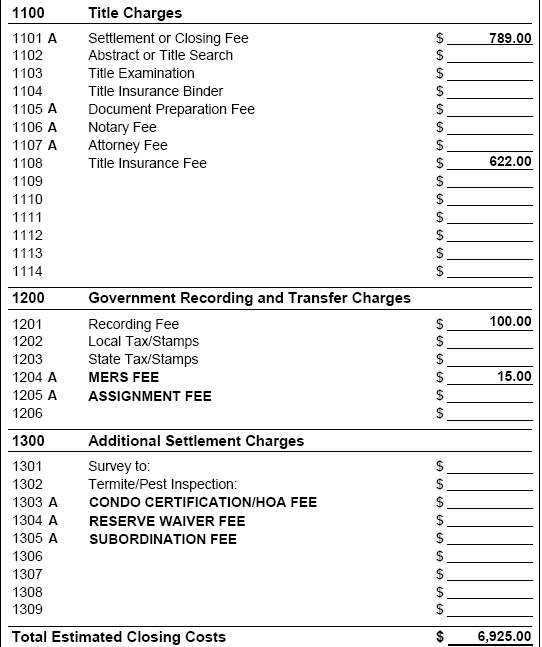

The first section covers which charges can increase, which have a limit of increasing no more than 10% and which can change.

If you decide to shop for your own title, escrow or home owners insurance and not use who the lender recommends, the lender is not responsible. If you use who the lender recommends, the total of those fees cannot increase by more than 10% at settlement.

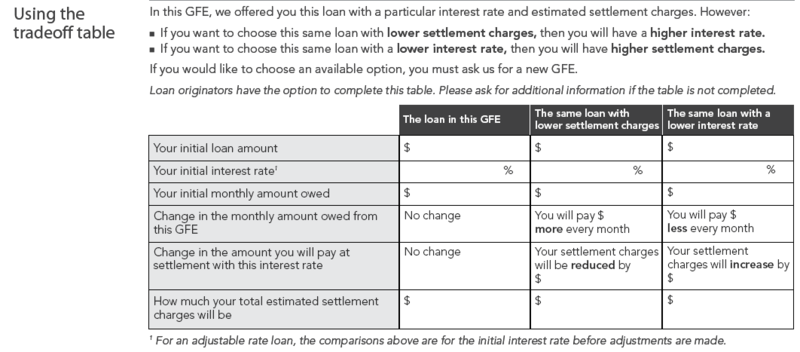

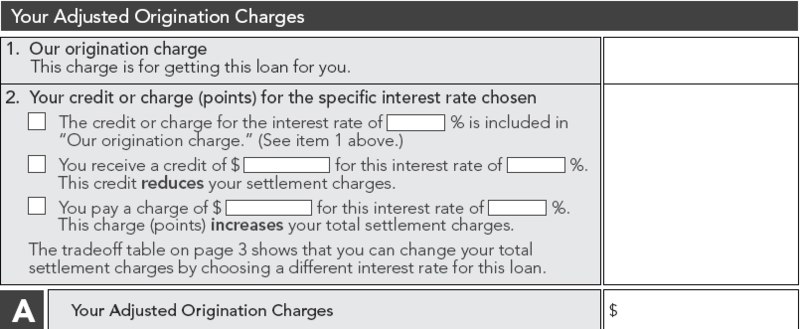

The Tradeoff Table is intended to help you select between various ways of having your mortgage priced. Your rate can be priced with or without points (or origination fees)–it is your choice. The mortgage originator is only required to complete the first column on the left.

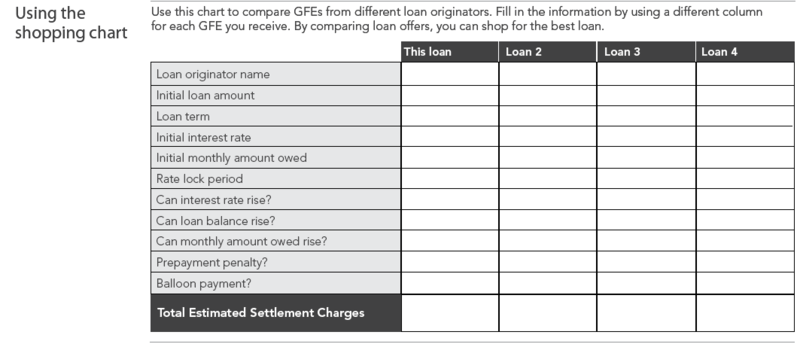

The Shopping Cart is intended for you to shop…shop…shop…to your hearts content. If you're a long time reader of The Mortgage Porter, you know I feel strongly that selecting who is going to help you with your mortgage by rate and cost alone alone can be one of the most expensive mistakes you make. Especially considering how challenging it is to accurately shop rates factoring in how often rates change and that unless you are locking in your rate at that moment, it's a moving target. Good intentions–but wrong message.

Why not add a box to this all ready long document where consumers can compare the qualifications of the mortgage professionals they're shopping? You're not at Target–you don't need a shopping cart.

Recent Comments