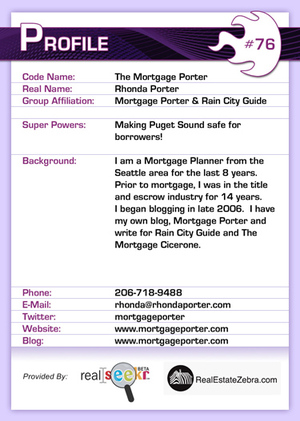

Hi Rhonda. Thank you for your helpful information on your website. The Gov’s FHA site is not very user friendly!I hope to be a first time homebuyer in the next year or so. I am working on repairing my damaged credit and know I need at least a solid year of "good payment history, etc" to demonstrate I’m a good buyer.I realize the higher the credit score the better…but what is the minimum score one could have to be considered for this type of loan? And what is the min down payment I could expect to pay? I’m hoping to purchase a condo in Kirkland for under $350K and just need to see what I should plan for. Thank you!

- FHA does require the last 12 months of a borrowers credit to not have late payments. As far as credit scores, FHA is not credit score sensitive–however some lenders will charge you a higher rate if your mid credit score is under 620. You can actually have no credit scores or shallow credit and possibly qualify with FHA by alternative credit.

- 3% is the minimum investment required by FHA currently except this is changing on January 1, 2009, thanks to the new law passed yesterday, to 3.5%. Based on a sales price of $350,000, the new required investment would be $12,250 (instead of $10,500).

- You may want to make sure that the condo is FHA approved or that it qualifies for a "spot approval" if it is not on HUD’s list.

Recent Comments