This is a term someone entered into a search engine, like Google, who wound up on my blog. “Is 714 a Good Credit Score for Buying a House?” is a fair question. Just a couple years ago, having clients with credit scores 700 or higher was considered “excellent”. In fact, previously credit scores of 680 or higher were considered good. Now with conventional loans, we have several brackets based on credit scores and loan to value. Many lenders are adopting this with FHA loans too.

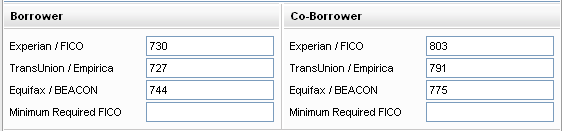

With credit scores, lenders look at the middle credit score and if there are two borrowers, like a husband and wife, the lowest middle score is what is used for pricing and underwriting.

Based on the above scenario, the borrower’s mid-credit score is 730 and the co-borrower’s mid-credit score is 791. For this transaction, 730 is the credit score that would be used for underwriting and pricing the interest rate.

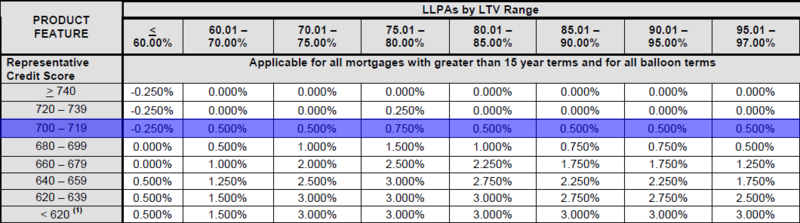

Let’s assume the mid-credit score of all borrowers on a proposed purchase is 714. The other factor that will impact the buyer is how much they are planning to use for their down payment. With a 20% down payment (80% loan-to-value), there is a 0.75% hit to fee for a borrower with a mid-credit score of 700-719 using a conventional loan.

With less than 20% down payment, this borrower will have private mortgage insurance which is why the “hit” to fee is reduced. The borrower will be paying additional for the conventional mortgage to purchase insurance which reduces risk for the lender.

NOTE: Just because the above graph shows price hits for scores below 620 and higher loan to values, this does not mean that these terms are available. Banks and wholesale lenders will price these products “out of the market” so that they are actually not available.

FHA insured loans do not have the same price hits as conventional mortgages. Many lenders currently have price hits for mid-credit scores from 620-660. And some may give preferred pricing if the mid-credit score is 720 or higher.

A consumer should consider both conventional and FHA insured loans, especially if they are putting less than 20% down. I actually have many clients who are opting for FHA loans over conventional because of the potential of allowing their loan to be assumed in the future when they decide to sell their current home.

And if you start working with a mortgage professional before you find a home you’re interested in making an offer on, they should be willing to help you review your credit to see if your mid-score can improve. A 714 mid-score is only 6 points away from 720 which offers better pricing with conventional programs. It may just be a minor adjustment such as paying a credit card down to 30% of it’s available credit limit or perhaps you recently closed an account (which can temporarily ding your credit score). It’s also important to know that the credit score that you have access to on-line is different than what a mortgage originator will pull (or than what an insurance agent or car salesmen will obtain) because of the scoring modules that are created specific for certain purposes.

There’s nothing wrong with a 714 mid-credit score. If you’re considering buying a home in the next year, do contact a mortgage professional soon. If you’re buying a home located in Washington state, I’m happy to help you review your credit.

Hello,

I have worked hard to clean up my credit. The negative items that are left on my credit are hard inquiries (most will be 2 years old in Sept 2016) and 3 late payments (last late payment was march 2015). My debt to income is 19%. My score right now is 678. If I did not apply for more credit and the hard inquires fell off, how long would it take form my score to reach 740? Is that possible

Hi Cristina,

Without seeing your actual credit report it’s hard to advise what you should do to improve your scores. If you are closing or not using accounts, your scores may go down. This is because the current scoring module prefers older, established credit. If you have credit that is older, I would recommend using the cards to make small purchases once a month – like a bag of groceries or a tank of gas and then pay it off monthly.

A score of 678 will still allow you to buy a home. WSHFC’s Home Advantage Mortgage does not have “price hits” to credit scores and FHA is also a flexible program.

I’m happy to help you if you’re buying or refinancing in Washington state (where I’m licensed).