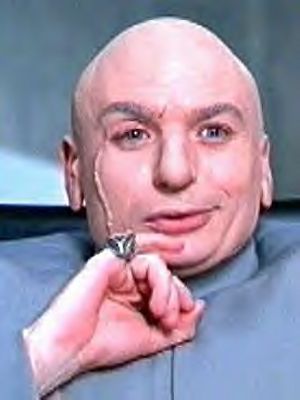

This four year old knows when to ask for help!

If you need help figuring the math out on your adjustable rate mortgage, don’t call 9-1-1…contact a qualified Mortgage Professional or the Loan Originator who helped you obtain your financing.

Helping Washington State homeowners learn more about their mortgage options.

This four year old knows when to ask for help!

If you need help figuring the math out on your adjustable rate mortgage, don’t call 9-1-1…contact a qualified Mortgage Professional or the Loan Originator who helped you obtain your financing.

West Seattle Blog just sent me an email (these guys are the BEST)

"Been meaning to write and say congrats for being the Citizen Rain blog of the week. Your mortgage information is endlessly fascinating…"

Apparently The Mortgage Porter is their "Blog of the Week".

"With foreclosures rising, this Seattle blog keeps readers in the know."

I am so honored! If you caught Mortgage Porter’s spot on King 5 news…please let me know.

Mike Kreidler, Insurance Commission for the State of Washington, would like Stewart Title to pay one-point-nine MILLION dollars for exceeding the $25.00 per year amount allowed to be spent on their customers. Again, this is just for Snohomish County other Puget Sound title insurers are under investigation.

Mike Kreidler, Insurance Commission for the State of Washington, would like Stewart Title to pay one-point-nine MILLION dollars for exceeding the $25.00 per year amount allowed to be spent on their customers. Again, this is just for Snohomish County other Puget Sound title insurers are under investigation.

The Notice of Hearing, which was filed today, includes a details of each violation dating back from December 2006. The list also discloses line by line advertising infractions including the real estate offices name and the initials of the real estate agents receiving the illegal inducement for business.

The read the Notice of Hearing, Download insurance_commissioner.pdf

Larry Cragun of Real Estate Undressed has the second round of nominees for the 2007 Magnificent 7 awards. He has 10 new post featured and he is requesting your help in narrowing down the selection to 7. I’m very honored to have another post in the running…especially with such great competition. Please take a few moments to read these articles that are packed with consumer content and vote for your favorite.

Here is another Rain City Guide re-run that I feel is worth visit that I wrote on April 7, 2007. I’m always surprised at how many people do not know the terms of their mortgages. It’s more important than ever…especially if you have an ARM or Balloon mortgage. BTW, the link to the massage therapist always cracks me up!

The other day, FOX news contacted me after reading one of my post wanting to interview some of my successful borrowers who once had a subprime mortgage. You wouldn’t know this from watching the news: a majority of subprime mortgages are performing well. It’s a minority that are not.

I was eager to help tell this story and sent an email out to a handful of my clients who once had subprime mortgages letting them know about this opportunity. No one responded. It made me wonder if they are embarrassed they once used "subprime financing"? With how it’s getting a big black eye, I guess I could understand how they feel. It’s too bad that more of the "good news" about this type of financing is not making the headlines.

The fact is, most of my clients who had subprime/alt-a mortgages are doing very well. They did what you’re suppose to do if you have a subprime mortgage:

Here are a few examples:

Single mom who’s self employed for one year but coming from the same line of work for five years with excellent credit. She had a track record of solid income however, conforming guidelines require two years of tax returns (for full doc) or two years of business licenses (stated/NIV). We provided a 30 year fixed mortgage using 6 months bank statements to document her income. She recently sold that home and is now in her next home which we were able to go "conforming" using the proceeds from her first home for the down payment.

Wife marries a "project" husband (her loving terms, not mine) where his past credit is a mess. Her credit is fine but he’s the primary wage earner. They were actually my first subprime loans. At that time, if you had a mid credit score of 600 or better, you could do zero down. They barely squeaked in. However, they did what subprime buyers are suppose to do: they worked on cleaning up their credit over the two year time of their mortgage had a fixed rate. They changed their spending habits and were responsible home owners. They since refinanced after their two year prepayment penalty was up. Having a mortgage has improved their credit score (as well as working on their credit) and they have benefited from the appreciation that the Pacific Northwest has offered them.

Young couple with three children living with the in-laws. Money was a little tight as far as the down payment was concerned. They had decent income and credit that was not quite established yet. They believed in not having credit cards. They were able to purchase their first home and move out of the folks house (a good move for everyone, I’m sure!) and later refinanced with higher credit scores and equity they gained by the time their purchase money mortgage was about to adjust.

Home buyers who used subprime mortgages to purchase their home, who had good advice from a qualified Mortgage Professional and who followed that advice, should not be ashamed to be associated with a subprime or alt-a mortgage loan. They did what you’re suppose to do, use it as band-aid financing.

Home owners who have a subprime mortgage and did not change their habits are probably going to be hurt in this market. If you currently have a subprime mortgage with an ARM or prepayment penalty adjusting within the next 18 months, please contact your Mortgage Professional as soon as possible so you can start working on your credit.

If you’re part of the first group, be proud! You improved your credit, manage your debts and spending patterns and became a responsible home owner.

I feel it’s important to continue to share with you the junk we receive in the mail from mortgage companies with amazing offers. Seems like the new trend is to go after people who may be facing foreclosures or who have adjustable rate mortgages.

Let’s take a peak inside these great offers!

The first one has red letters on the upper right corner stating:

"FINAL NOTICE OF RATE INCREASE". The next line: "RE: Mortgage Master Svc Corp.".

Wow. Looks pretty official and they must know about us because we did get our mortgage at Mortgage Master (where I work). Once you tear open this important looking notice, it appears to be a check from the "funding department" for $375,000. That is our mortgage balance and we do have an ARM. The letter states they have "reviewed our original mortgage loan" and that we "qualify for a Low Cost Refinance or a No Cost Refinance…your new rate could be 4.125% (APR 6.439%)".

The second letter has big bold black says "FINAL NOTICE-Notice of Overpayment". Yikes…we don’t to be overpaying anything! This gem states that "according to their records, you may be making larger than required payments on your home loan" and is offering us a fixed rate for five years at 1.75% (APR 7.012%). Huh? I thought we were making the payment due according to our lender.

The purple envelope really cracks me up. It’s hand addressed on the front and the back of the envelope even has a little smiley sticker. This must be from a dear friend. This is not a mortgage offer, instead they say "We’ll buy your house…even if the stairs are missing". It’s a two page letter with testimonials and reasons not to use a real estate agent…they’ll help you do everything no matter what condition your house is or how desperate you are to sell. RUN! I checked out there website and there is no information about this organization or more importantly, the people who are behind it. Are they licensed? Smells fishy to me. Maybe it’s the smiley sticker. If you need to sell your home and you don’t have a real estate agent to work with, please contact me and I’ll try to help you with a referral to one.

If someone needs to send mail (or do "cold calls") to strangers to stay in the mortgage business, it’s because they do not provide the level of service that would create referrals from their clients. They treat their business/clients as "transactional" instead of "long term relationship". If you’re working with someone who is "transactional", they’re only planning on working with you once; you probably won’t want to return to them for your next mortgage.

I don’t appreciate scare tactics and I hope you don’t fall for their gimmicks. Ask for referrals from people you respect and trust if you are in need of a mortgage or real estate professional (or read their blogs).

PS: If you receive a misleading offer in the mail that does not disclose APR or that appears to be from the government (you know, the gold envelopes with an eagle on the outside usually sent around April so you think it’s a tax refund) and you’re in Washington State, please send it to me. If it’s a violation, I’ll forward it to DFI.

I hope you’ll enjoy reading an earlier post of mine that I featured at Rain City Guide. This article was originally written by me on February 13, 2007. Recently FOX News contacted me about it wanting to speak with some of my successful clients who were once considered "subprime". It’s too bad I had a real short notice and could not help them out. The "successful subprime" borrowers outweigh the others by far. Without further ado…

There’s No Love for the Subprime Borrower

It’s all over the news, we’re hearing about major subprime lenders having to restate their losses and every day, lenders are coming into my office to inform us of changes to their guidelines. This is all good, right? It will be tougher to provide loans for home buyers who maybe should be spending more time to learn about budgeting and using their credit cards. What about the people who are all ready in these programs?

First, allow me to explain the basic dynamics of these loans. Many of these mortgages are zero down, 80/20s (80% of the loan to value for the first mortgage/20% of the value for the second mortgage). The first mortgage is typically offers a fixed rate for 2-3 years with a prepayment penalty (the standard is six months interest) that matches the fixed rate period. In addition, the mortgages may be interest only or amortized at 30, 40 or 50 years. The rates on these mortgages are completely dependent on credit score.

When I meet with Mr. and Mrs. Subprime, I advise them of their options of buying now using this type of subprime mortgage or that they can work on their credit, job history, etc. and buy later with a better mortgage program. Because there are no guarantee of what rates will be (or maybe because they know there’s not guaranteed they’ll clean up their act) and because they want to buy a house now, they often opt for the subprime mortgage. Once this happens, I heavily stress (or Jillayne would say, I lecture ![]() —which I’m sure I do) to Mr. and Mrs. Subprime that they have 2-3 years to change their spending habits because once their fixed period rate is over, their mortgage is going to adjust and do so big time. I let them know that I want them to be in the best position for a refinance into permanent financing (or to have a better mortgage should they decide to sell the home assuming they have any equity) and that the subprime mortgage they are using to obtain their home is temporary financing.

—which I’m sure I do) to Mr. and Mrs. Subprime that they have 2-3 years to change their spending habits because once their fixed period rate is over, their mortgage is going to adjust and do so big time. I let them know that I want them to be in the best position for a refinance into permanent financing (or to have a better mortgage should they decide to sell the home assuming they have any equity) and that the subprime mortgage they are using to obtain their home is temporary financing.

Many of my clients in these mortgages have done very well and I’m proud of them. They have taken the responsibility of owning a home and having a mortgage to heart. I’m able to restructure the original mortgage and improve their situation greatly. The concern is for Mr. and Mrs. Subprime who just didn’t get the hang of it. They continued to charge up their credit cards, they bought or leased a new car to go in their new driveway and maybe a new TV, too. They’ve been sliding ever since the holidays and are now having a tough time paying their mortgages on time. Maybe they just have one mortgage late. Their credit is rough at best. Their fixed period (and prepayment penalty) is over and now they really need to refinance fast because their mortgage has adjusted for the first time—their rate is now 2% higher. Their situation has gone from bad to worse. With all the tightening in the subprime market, even if their credit scores and scenarios are the same as when they bought, there may not be a program for them to refinance out of now. They will be forced to sell (hopefully they have enough equity to pay commissions and other closing costs) or to somehow manage to choke down their increased payments.

I guess this post is a plea of sorts. If you currently have a subprime loan (especially the type I described) please contact your Mortgage Planner to have your credit reviewed to make sure you’re on the right track to be able to refinance (or have a better loan for when you sell) when the time is due. Do not assume there will be a program for you if you have not made significant changes to your spending and use of credit cards. If you’re a real estate agent or loan originator, check in on your subprime clients to let them know of the changes in the industry…see if they need guidance to stay or get on track so they don’t wind up stuck with a higher mortgage payment, being forced to sell or foreclosure.

![]() Rhonda Porter is a Licensed Mortgage Originator MLO121324 living in the greater Seattle area. Rhonda began her career in 1986 in the title and escrow industry and began her mortgage career in 2000. She enjoys helping people understand the mortgage process and started writing The Mortgage Porter in late 2006. Read More…

Rhonda Porter is a Licensed Mortgage Originator MLO121324 living in the greater Seattle area. Rhonda began her career in 1986 in the title and escrow industry and began her mortgage career in 2000. She enjoys helping people understand the mortgage process and started writing The Mortgage Porter in late 2006. Read More…

Copyright © 2025 · Education Child Theme on Genesis Framework · WordPress · Log in

Recent Comments