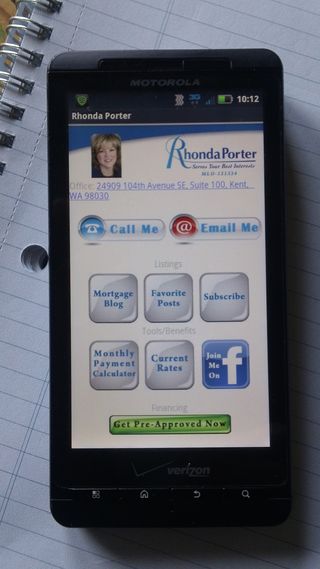

I'm pleased to announce the release of my first ap for smart phones, specifically Androids (I'm hoping to follow up with one for iPhone soon).

I'm pleased to announce the release of my first ap for smart phones, specifically Androids (I'm hoping to follow up with one for iPhone soon).

Currently* from this app, you can contact me or connect via Facebook. There's also a mortgage calculator, convenient links to my blog and favorite posts AND a button to start the preapproval process.

Just another way for us to keep in touch and for you to refer friends, family members or co-workers who are considering obtaining a mortgage for their home located in Washington.

*This is brand, spanking new and I'm sure we'll be tweaking it as time goes on.

What features would you like to see?

Download: http://bit.ly/rhondaporter

Recent Comments