My title and escrow partners at The Talon Group are at it once again. This time, they’ve produced an entertaining video on how to read your title commitment. Whenever you buy, sell or mortgage your home, odds are you receive a title commitment (aka title report). It’s important to take a few moments to review what’s showing against your property.

What is a Reconveyance?

This informative video from The Talon Group explains what happens with a reconveyance. A reconveyance takes place when an existing deed of trust (aka mortgage) is being paid off. Watch this short video to learn more.

What is Title Insurance?

The fine folks at The Talon Group answer a question on everyone’s mind: "what the heck is title insurance?" in this short video.

It’s good to understand what is covered with a title insurance policy. Typically the seller pays for the buyer’s policy (Owners Policy) which assures the buyer of issues such as vesting (the seller is authorized to sell the property) and that the title is free and clear of liens. The buyer generally pays for the lenders policy to assure the lender will be in first lien position (Lenders Policy).

Unlike other forms of insurance (auto, health, home, etc.), there are no renewal fees. Title insurance actually covers you from the point of recording the new deed backwards into time.

Stay tuned for more videos from the cast and crew and The Talon Group.

Vesting: How to Take Title for Your Real Property

UPDATE 1/5/12: With First American Title absorbing The Talon Group, apparently they decided to take down many of the videos the talented crew at Talon created for consumers. Here is a pdf that contains information on vesting: Download Different Ways of Holding Title.

UPDATE 5/15/2013: Wow! It looks like this video is back… thanks, First Am!

If you are buying a home in Washington State, it’s important to consider how you are going to hold title (vesting), especially if you’re buying with another individual and you are unmarried. Tim Daniels, Chief Title Office of The Talon Group, shares various ways people can consider for vesting of their real estate property.

What takes place between signing and closing?

What happens between signing documents and closing? Watch this video featuring The Talon Group’s Chief Title Officer, Tim Daniels as he explains what happens with your loan documents after you finish signing at the escrow company.

That’s Not Me: Numerous Matters and ID Affidavits from the Title Company

If you have a common popular name, like Smith, Jones or Hernandez; you may be asked to complete a form from the title insurance company. This is so that instead of listing many judgments that are against the same name as yours on the preliminary title commitment, the Title Department and use the ID Affidavit to determine whether or not the items shown are against you. Tim Daniels, Chief Title Officer with The Talon Group, explains more in this video.

<<Video Deleted>>

Sadly when First American absorbed The Talon Group, the deleted many of their education and entertaining videos.

Local Title Company Raises Rates 30%

Normally this wouldn’t be big news…but when Northpoint Title decided to drop their rates well below market and agressively try to pull existing title orders from other companies only to raise their rates one month later, I think it’s worthy some attention. Here’s an example of an email from a Northpoint rep to a real estate agent (dated June 16, 2008):

"Just checking in to see what you thought about the new title rates. Can you believe we are 28% lower?? This is fantastic! Here is a price comparison on an average sales price of $275,000:

Fidelity/Chicago: $840.00

FATCO/Talon: $840.00

OUR RATE: $605.00

This is a big difference in the bottom line for your clients. Let me know if you have any titles you would like me to pull over. I would be thrilled to help you out!"

Northpoint is a Landamerica "venture". This email excludes the other local Landamerica title companies (which represent 25% of the total resale market in King County alone), Commonwealth of Puget Sound and Rainier Title who’s title rates (at the time) were 33% higher than Northpoint at this price point.

This tactic was used an attempt to gain title business on existing transactions without any regard to what was negotiated in the purchase and sale agreement. Not to mention the effort or cost involved in producing the all ready provided title commitments.

Northpoint justified their deep rate cut because they were a "green" title company, promoting being paperless which many title companies are (this is not unique). From a separate Northpoint email dated June 16, 2008:

"I have some good news! Northpoint’s paperless workflow system has effectively reduced our waste and costs, resulting in tremendous costs savings. To help consumers in today’s challenging real estate market, we ahve decided to pass this savings on to your clients. We filed new, lower rates with the Office of Insurance Commissioner and the rates became effective on Tuesday, June 10th…Please pass along this good news to your clients. I look forward to working with you."

On July 7, 2008, Northpoint suddenly was not green anymore nor were they planning on passing any savings along to consumers. Just shy of one month, they filed a rate increase following their huge marketing blitz all based on rate. Presentations were being made to offices promoting the low rates even after the new higher rate was filed with the State.

Effective August 1, 2008, Northpoint’s rates are the same as Commonwealth of Puget Sound and Rainier Title. They are 33% higher than what they’ve been pushing (and pulling) over the past month. They are in line with the other title companies rates.

Title rates are not changed on a whim. If you’re a long time reader of Mortgage Porter, you know that my background is title insurance and escrow and that my husband is in the title industry. As a former manager, I can tell you that title rates are discussed and studied several weeks if not months. Not to mention the time and effort it takes to file rates with the State. (Washington title rates are public record, filed in Olympia).

In my twenty+ years in the real estate industry, I have never witnessed a title company use what appears to be bait and switch.

My 22nd Anniversary in the RE Biz

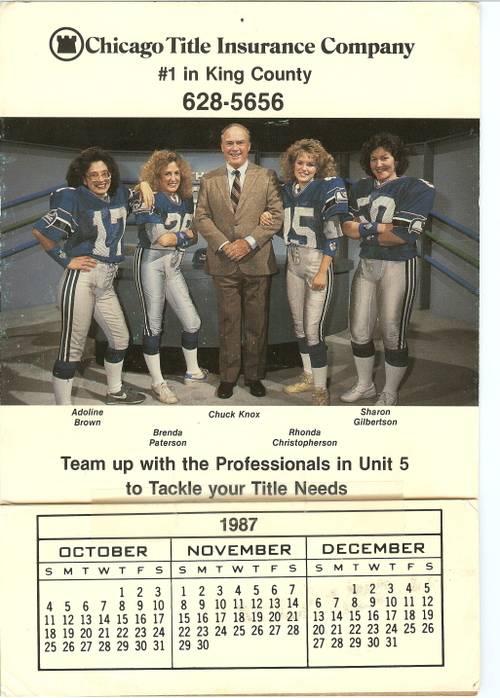

I should stop saying how long I’ve been around the real estate industry! On May 1, 1986, a very bright-eyed and naive young Rhonda Christopherson, began my first “real job” at Safeco Title Insurance Company as a doc-puller (we were bought a year later by Chicago Title, where I worked in Unit 5).

After 14 years in the title industry, I made the move to mortgage and I’ve been helping Washington families with their Mortgage Planning needs for the past 8 years…the rest is history!

Yes…that is Chuck Knox, that was my hair style in the 80s and yes, I’m wearing yellow Reeboks with actual jersey.