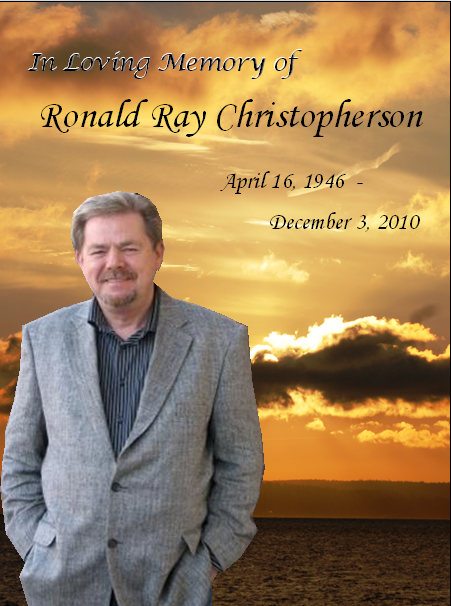

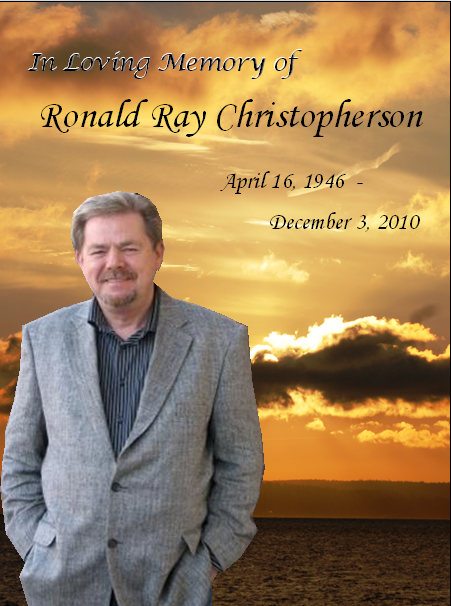

Dad's services will be on Monday, December 13, 2010 at Nativity Lutheran Church in Renton at 12:00 p.m. Internment will be at Greenwood Memorial Cemetary.

Update: Here is Dad's obituary as printed in the Seattle Times.

Helping Washington State homeowners learn more about their mortgage options.

Dad's services will be on Monday, December 13, 2010 at Nativity Lutheran Church in Renton at 12:00 p.m. Internment will be at Greenwood Memorial Cemetary.

Update: Here is Dad's obituary as printed in the Seattle Times.

Just over a week ago, I was invited by Professor Richard Green to participate on a panel at USC Lusk Center for Real Estate. One of the wonderful benefits about blogging is that I’ve met so many people and have had amazing experiences that without my blog, odds are I would not have opportunities such as this. Richard and I have had conversations via social media over the past few years but this was our first time meeting “IRL” (in real life).

This was an evening class with around 100 students of all ages and backgrounds. Some are full time students, others have day jobs and a few admitted to being former mortgage brokers. I was on the panel with two gentlemen. One is a private banker from Beverly Hills with Wells Fargo. He originates high end mortgages and he has worked in wholesale too (wholesale reps call on non-bank mortgage originators, like mortgage brokers and correspondent lenders to send their bank loans). The other gentleman is more on the “after” the mortgage is originated scene. He deals with “scratch and dent” mortgages. Basically, a ”scratch and dent” mortgage is one that the intended lender/investor refuses to buy due to errors made on the loan or possibly even fraud. It’s very expensive for banks and correspondent lenders wind up with a “scratch and dent” mortgage in their credit lines. His company purchases scratch and dent mortgages (at a discount). They may then review the issues causing the mortgage to be considered “scratch and dent” and may try to correct or improve the issue with the goal of being able to sell the mortgage. I represented a “classic” residential mortgage originator…almost sounds a little boring compared to my fellow panelist!

Professor Green had a few questions cued for us to answer and class participated with their questions as well. The discussion ran from underwriting issues with residential mortgages to how guidelines were influenced by what Wall Street would buy. By the way, it sounds like reserves (how much liquid assets are remaining after closing) is carrying more weight than credit scores when potential investors are looking at purchasing mortgage backed securities. Reserves are becoming a more important factor with forecasting the performance of a mortgage (the higher the reserves equals lower odds of default). This was probably one of the most surprising nuggets of the evening to me.

Professor Green asked me to address why I never originated an Option ARM when so many other mortgage originators did. Students question how effective the current credit scoring modules are and if larger down payments should be required with FHA insured loans.

The closing question caught me off guard a bit. Professor Green asked if we see ourselves in our current careers five years from now. I’m very concerned that we could see only a few choices for American consumers with regards to their mortgages–meaning the banks (3 or 4) have it all. Without competition, mortgage rates and fees will be higher. Congress all ready holds mortgage bankers to a lower standard than a non-bank originator per SAFE Act requirements. Many banks are touting the newer compensation structures of their LOs as a benefit to consumers but if the LO is making less and the rate is the same or higher — is it better for the consumer if they pay more (and the bank is making more)?

My hope is that I can continue doing what am doing. Originating residential mortgages at a non-bank mortgage company. Mortgage Master Service Corporation has been a family owned company since 1976–this is where I belong. My father-in-law, Bob Porter, retired from Mortgage Master Service Corporation in his seventies. I would like to do the same.

I am very honored that Professor Green invited me to participate on the mortgage panel for his class. Over the years, I’ve received plenty of attention and speaking opportunities regarding my social media efforts (which I’m thankful for)… to be selected to share my knowledge of residential mortgages and my opinions with a room of students from USC is a true highlight for me and something I will always remember. I wish I could have recorded the entire event.

PS: Be sure to check out: Richard’s Real Estate and Urban Economics Blog

Your eyes are not playing tricks on you. My blog is pink and will be pink throughout the month of October for National Breast Cancer Awareness Month and in honor of Michelle Brown, my friend and co-worker who lost her life to this disease.

Dawn Appel is a former employee of The Talon Group. She has been couragously battling leukemia. From 8:00 am – 4:00 pm today in Issaquah, you can get your car washed to help raise funds in her honor and to help support her family.

If you can't make it to the car wash but would still like to donate click here.

Nope…we're past April 1st…this is no joke and I'm sorry BUT I do not find anything about this man "beautiful". During an interview yesterday on CNBC, a representative from People Magazine said that some people are beautiful "on the inside". With that, I agree.

about this man "beautiful". During an interview yesterday on CNBC, a representative from People Magazine said that some people are beautiful "on the inside". With that, I agree.

I admit that I do not personally know our Treasury Secretary, Mr. Geithner. Maybe he is a beautiful person….who only paid past due income taxes because of his new political position.

I typically only read People Magazine when I'm in a doctors office.

UPDATE: This explains everything!

Dawn Appel is a former employee of The Talon Group. She has been couragously battling leukemia. From 8:00 am – 4:00 pm today in Issaquah, you can get your car washed to help raise funds in her honor and to help support her family.

If you can't make it to the car wash but would still like to donate click here.

![]() Rhonda Porter is a Licensed Mortgage Originator MLO121324 living in the greater Seattle area. Rhonda began her career in 1986 in the title and escrow industry and began her mortgage career in 2000. She enjoys helping people understand the mortgage process and started writing The Mortgage Porter in late 2006. Read More…

Rhonda Porter is a Licensed Mortgage Originator MLO121324 living in the greater Seattle area. Rhonda began her career in 1986 in the title and escrow industry and began her mortgage career in 2000. She enjoys helping people understand the mortgage process and started writing The Mortgage Porter in late 2006. Read More…

Copyright © 2026 · Education Child Theme on Genesis Framework · WordPress · Log in

Recent Comments