In his speech at Operation HOPE Financial Dignity Summit yesterday on the challenges of the housing market and mortgage lending, FOMC Chairman Bernanke expressed concerns that mortgage underwriting has become “overly tight”.

“…Some tightening of credit standards was an appropriate response to the lax lending conditions that prevailed in the years leading up to the peak in house prices. Mortgage loans that were poorly underwritten or inappropriate for the borrower’s circumstances ultimately had devastating consequences for many families and communities, as well as for the financial institutions themselves and the broader economy.

However, it seems likely at this point that the pendulum has swung too far the other way, and that overly tight lending standards may now be preventing creditworthy borrowers from buying homes, thereby slowing the revival in housing and impeding the economic recovery.’

Borrowers who have recently purchased a home or closed on a non-streamlined refinance would most likely agree with Ben Bernanke’s views on underwriting guidelines. And for the most part, I do too. Today’s home buyer will often find every aspect of their income, assets and credit scrutinized. For example, Form 4506 (which was once used primarily for stated or no-income verified loans) is now pulled on every mortgage in process to obtain a copy of the tax transcripts for the the past two years. Any discrepancies between the 4506 and income supplied must be addressed, which often leads to the borrowers having to provide complete tax returns instead of just their W2’s. If a borrower has deposits on their bank statements that are not easily identified, they can expect to show proof of where that deposit came from. Credit reports may disclose information that the borrower may need to address as well beyond the good old “inquiry letter”. Now they disclose information about activity associated to a borrowers address that may or may not relate to the borrower. Don’t get me wrong, loans are closing however the process for some can require a great deal of patience and paperwork.

“When lenders were asked why they have originated fewer mortgages, they cited a variety of concerns, starting with worries about the economy, the outlook for house prices, and their existing real estate loan exposures. They also mention increases in servicing costs and the risk of being required by government-sponsored enterprises (GSEs) to repurchase delinquent loans (so-called putback risk).”

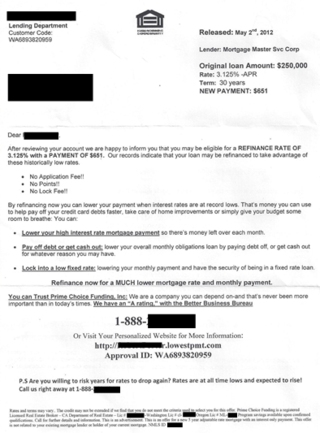

“Putbacks” are also referred to as “buy-backs”. And buy-backs tend to roll down hill to the source that originated the mortgage, including banks and correspondent lenders like Mortgage Master Service Corporation. This happens when the loan (borrower) is not performing. The lender will go over the loan documents with a fine tooth comb to try to find fault in the underwriting so they can justify sending the loan (forcing a buy-back) to the originating lender. This is why many borrowers are having to over-document their finances.

The Federal Reserve’s Senior Loan Officer Opinion Survey on Bank Lending Practices indicates that lenders began tightening mortgage credit standards in 2007 and have not significantly eased standards since.

Ben Bernanke and the Fed cannot control the underwriting guidelines and overlays that banks have for mortgage lending. I certainly do not want to see the loose underwriting of the subprime era return. However I do agree that for the most part, underwriting has become pretty tight and I would welcome more “common sense” for well qualified borrowers.

Mr. Bernanke needs to brush up on Frank Dodd and how it will continue impact the mortgage industry and underwriting guidelines.

Your thoughts?

Recent Comments