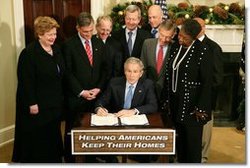

Included in the Mortgage Forgiveness Debt Relief Act that President Bush signed just before Christmas is the continuance of being able to deduct private and FHA mortgage insurance if you meet certain criteria through 2010.

- The mortgage must be used for "acquisition indebtedness" which means for purchasing your home or a refinance doing substantial improvements. This also includes refinancing the mortgage you used to purchase your home, however the amount is based on what the original loan amount was when you purchased your home.

- The deduction applies to "qualified residences" which is your primary residence and a second home that is not a rental.

- Adjusted gross incomes up to $109,000 qualify for the deduction. Adjusted gross incomes of $100,000 or less are allowed to deduct 100% of the allowed pmi. AGI’s of 100,000.01 – $109,000 are on a sliding schedule (the higher the income, the lower the deduction).

- You must itemize your taxes in order to obtain the deduction (you need to do this in order to claim your mortgage interest deduction as well).

Consumers should meet with their Mortgage Professional to help them consider all options before selecting a mortgage.

Recent Comments