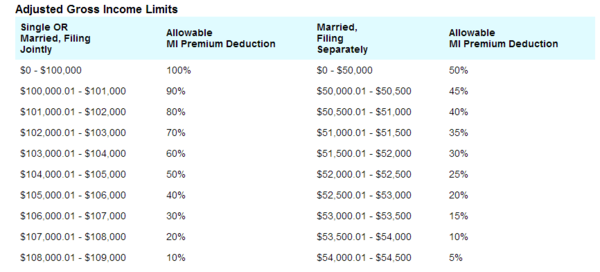

Home owners who acquired their home after 2006 and who have mortgage insurance may be able to treat the mortgage insurance premiums as they would their mortgage interest deduction when they file their 2013 income taxes. This is per IRS Publication 936.

Here are some basic requirements:

Recent Comments