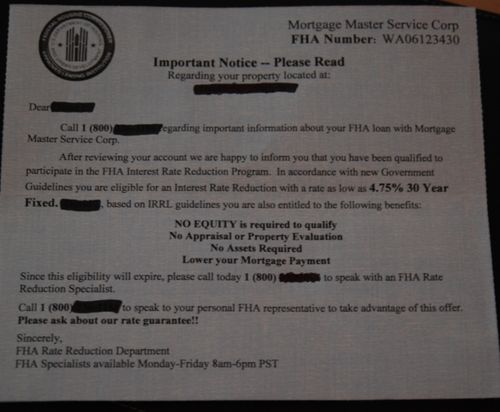

Seems like junk mail from random mortgage companies are on the rise again. I recently had a client who I helped with a home purchase utilizing an FHA mortgage send me a piece of junk mail that he had received from a company (NOT Mortgage Master) that bothered him beyond the typical "deluge of refi offers from firms who's marketing strategy is to look up public records for a targeted mailing".

Some mortgage originators will buy list of home owners who have a specific type of mortgage, such as FHA, where they can offer a streamline refinance thinking if they use your originating mortgage companies name enough times, they just might fool someone into calling them.

This piece of mail junk has many red flags that home owners should be aware of.

There is no return address on the mailer anywhere. You have no idea who you will be calling or if they are even approved to do business in Washington State. I would never contact a mortgage solicitor if you have no way of researching them first.

They are also miss-using HUD's logo in the upper right corner as if it is there own. This is a big time no-no that I'm sure HUD would be interested to see.

There is no APR to go along with the rate and the small print on this doozie must be too small for my old eyes.

It is true that FHA streamline refinances do not require an appraisal (therefore you are not proving equity) and assets are not verified either. However the scenario still needs to qualify and HUD frowns about this type of marketing.

The eligibility for a streamline FHA refinance DOES NOT EXPIRE. This is a weak attempt to try to create a "call to action" to the home owner. HUD or lenders couldchange guidelines that would have an impact on an FHA streamline refi.

Oh by the way, IRRL is a term used for VA "streamlined" refinances–not FHA.

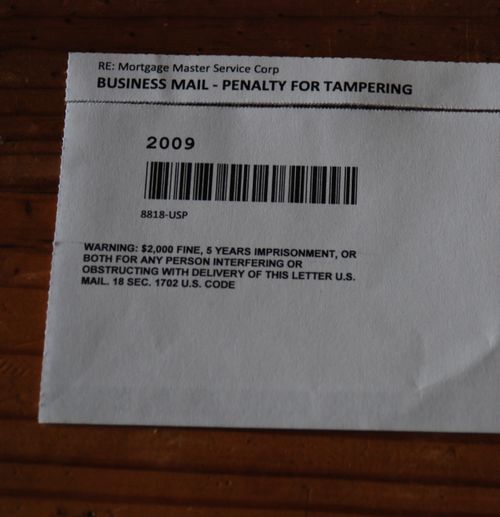

What really pushed my clients button was the outside of this mailer garbage.

Another attempt to make this look like it came from Mortgage Master and a nice little threat as a bonus to really make sure you don't disregard their efforts.

I've written about junk mail before many times at Mortgage Porter. You are welcome to forward this type of crap to the local officials. They do not want consumers mislead or taken advantage of either.

As a Washington State home owner, or if you're receiving mail from a mortgage company in Washington State, you can forward mail that you feel is misleading to DFI:

Enforcement Unit, Division of Consumer Service

DFI, P.O. Box 41200, Olympia, WA 98504

A letter like this should also be forwarded to HUD.

I strongly recommend not selecting your mortgage professional by what randomly lands in your mail box.

Recent Comments