This afternoon, I learned that the local operations of First American Title Insurance Company are merging their divisions of Pacific Northwest Title and The Talon Group into First American.

From First American Title's email announcement:

First American Title, Pacific Northwest Title and The Talon Group are combining forces effective October 1, 2011. In Washington and Oregon counties where we currently operate under these multiple brands we will be consolidating into a single operation to serve you and your clients as First American Title Company.

According to Pacific Northwest Title's "Our Story" page, they were established as an independent title and escrow company in 1983 and was purchased by First American Title in 2004.

The Talon Group was actually created by First American Title as a new brand when they purchased Escrow Partners in 2003. This event strikes home for me as my husband has been an employee at The Talon Group in this area since it's inception. And as "a spouse" I've had the fortune to get to know many of excellent folks at Talon over the years.

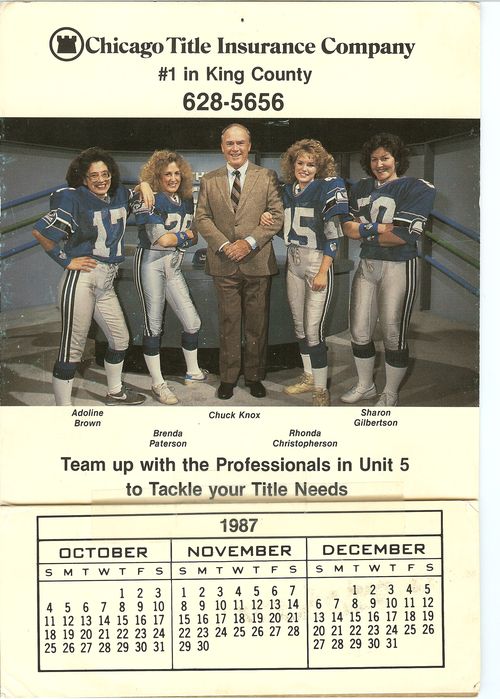

As someone who began in the real estate industry back at Safeco Title Insurance in '86 just prior to Chicago Title's acquisition, I understand what many of the employees must be feeling right now.

For more information, please contact your local First American, Talon Group or PNW title rep.