If you live in King, Pierce, Snohomish or many other Washington state counties, you have some sticker shock when you see your 2018 property taxes. King County is reporting that the average home will see their taxes increase by 17%. The City of Sumner in Pierce County may see a whopping 22% jump to their property tax. [Read more…]

If you live in King, Pierce, Snohomish or many other Washington state counties, you have some sticker shock when you see your 2018 property taxes. King County is reporting that the average home will see their taxes increase by 17%. The City of Sumner in Pierce County may see a whopping 22% jump to their property tax. [Read more…]

Archives for February 2018

Higher Property Taxes Impacts Everyone

Mortgage Rates March Higher

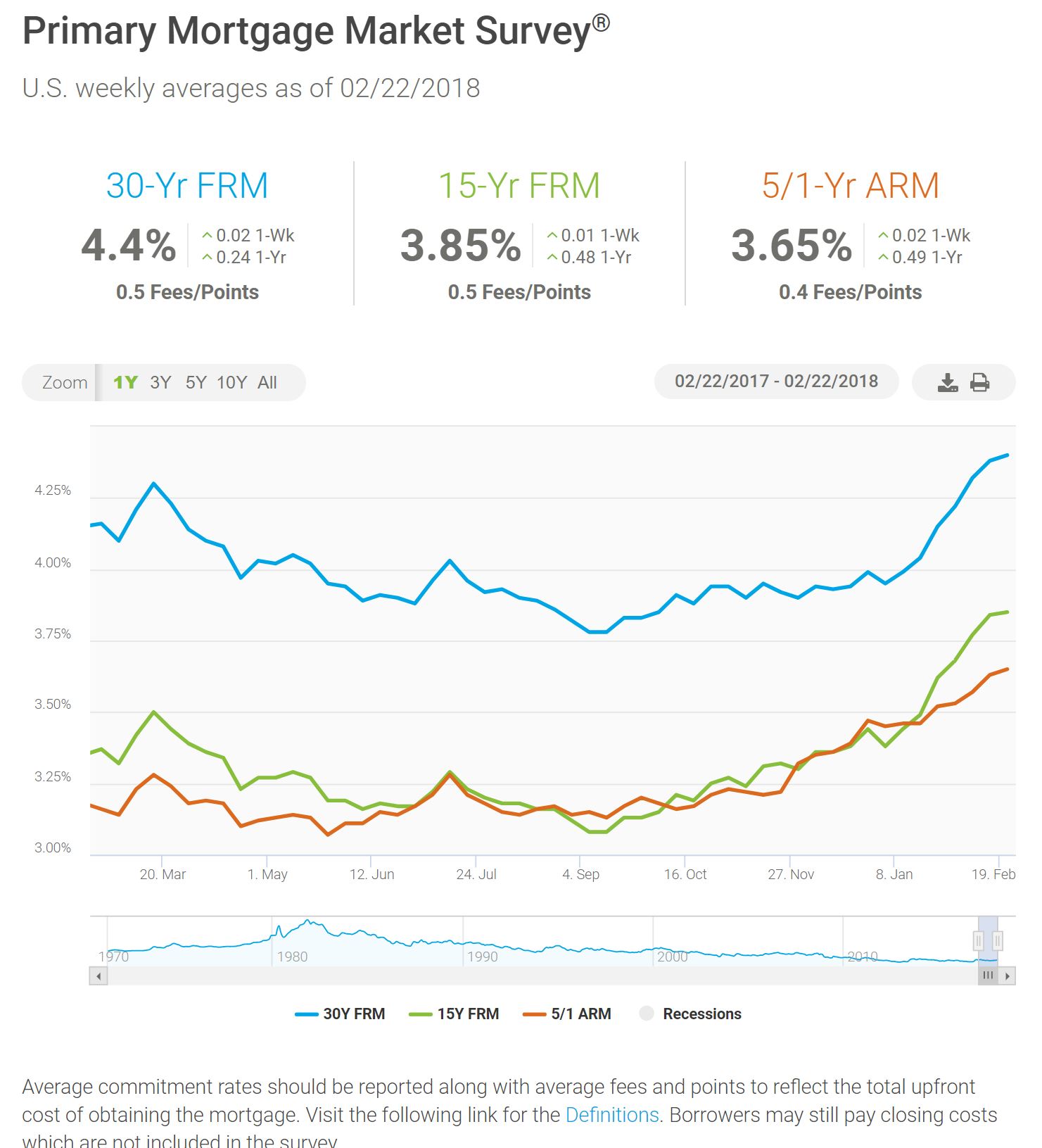

Freddie Mac released their Prime Mortgage Market Survey today showing mortgage rates continuing to trend higher.

The PMMS report is based on an average of conforming rates from last week. This is the seventh consecutive week that mortgage rates have moved higher based on this report.

Historically, our rates are still very low. Don’t believe me? Check this out. [Read more…]

Mortgage interest rates moving higher

This morning, Freddie Mac released their weekly report on the direction of conforming mortgage rates. The graph from the Prime Mortgage Market Survey is quite telling. Mortgage rates have been pushing higher for the last 6 months. As the economy improves, it would be likely to see rates continue in this direction. The 30 year fixed is up 0.44 in rate from the low of 3.78 recorded in September 2017 and has not been reported this high since last March. Click here for quote with current mortgage rates.

On

On

Recent Comments