Mortgage rates are based on mortgage backed securities (bonds) and may change throughout out the day. Investors will seek the safety of bonds when stock markets are deteriorating. The reverse is true: good news for the economy (as well as inflation) tend to cause mortgage rates to rise.

Here are some of the economic indicators that are scheduled to for this week (no economic reports were released for Monday):

Tuesday, March 14: Retail Sales and FOMC Meeting

Thursday, March 15: Producer Price Index (PPI), Initial Jobless Claims, Empire State Index and Philadelphia Fed Index

Friday, March 16: Consumer Price Index (CPI), Capacity Utilization, Industrial Production and Consumer Sentiment Index

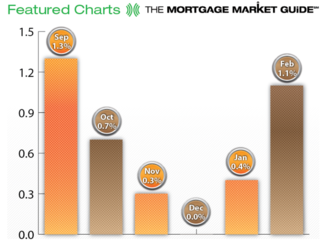

This morning, Retail Sales came in showing a nice bump up of 1.1% with positive revisions for January’s figures. Retail sales indicates consumers spending.

As I write this post (8:45 am pst), the DOW is up 108 and MBS (mortgage backed securities) are continuing to deteriorate positioning mortgage rates to trend higher.

Mortgage rates are still very low. What is changing is the cost (discount or rebate) for that low mortgage rate. Folks who are anticipating for mortgage rates to drop lower will have to bet on the economy not recovering.

In a few hours, we will have the Fed’s interest rate decision. We all ready know that it highly unlikely the Fed will make any changes to the Fed’s Fund Rate, which is to stay at 0 to 0.25%. This is good news to those who have home equity lines of credit which is attached to the prime rate (prime rate follows the Fed Funds Rate).

Markets will react not so much as to what the Fed does with rates (leaving them unchanged) since this has already been factored – it’s what the Fed will say about the possibility of QE3 when the rate decision is announced. Stay tuned!

If you would like me to provide you a mortgage rate quote for your home located anywhere in Washington state, please click here.

Discover more from The Mortgage Porter

Subscribe to get the latest posts sent to your email.

Please leave a reply