It really gets my goat when I see statements on the internet that are intended to lead the consumer to believe that someone or some institution is better than someone else…especially if the comment that is being spewed seems misleading to me.

Just a few moments ago on Twitter, a mortgage originator from Bank of America posted:

Bank of America DOES NOT CHARGE OVERAGES/POINTS to close Home Loans. Building trust with our customers is #1!

Her “tweet” also included a link to an article from Jack Guttentag which has me a bit riled and I’ll probably address soon in a separate post. [see update below].

Bank of America has changed their compensation program for their mortgage originators. It’s my understanding the mortgage originators are rewarded based on the volumes they originate. (I have serious concerns on how this is better for the consumer). This will continue to happen with banks and I believe that DFI is in the process of trying to do the same with mortgage originators who are licensed in Washington State. A consumer might assume that due to the tweet above, they’re paying less for a mortgage rate and perhaps should select this mortgage originator and/or the bank she works for.

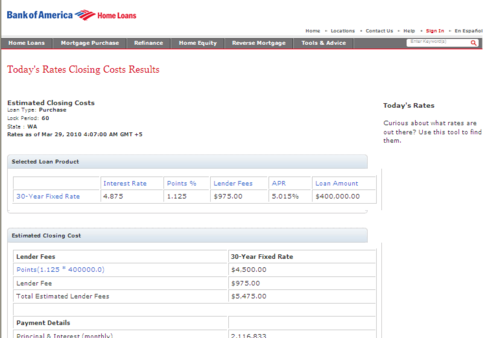

I decided to check out Bank of America’s website to price a rate based on the same criteria I used this morning. Their rate for a 30 year fixed mortgage in Seattle was not only 0.125% higher in fees, it’s also 0.125% higher in RATE than what I quoted hours ago.

This clearly states 1.125% in points to be paid for a 30 year fixed at 4.875%. (click on image for a larger picture).

UPDATE: Here’s Jack Guttentag’s definition of an overage, per the article the Bank of America mortgage originator tweeted about:

It is the difference between the price a lender posts with its loan officers — which is the price the lender expects to receive — and the price the loan officer charges the borrower. If the posted price is 5 percent and zero points, for example, and the loan officer charges the borrower 5 percent and half of a point, the half-point is the overage

Perhaps it’s an overage only if the mortgage originator is compensated the gain? What if it’s the bank who’s gaining the overage–is it okay to have the consumer pay more then? Banks are…well…banking it.

Consumers need to continue to be aware and to be responsible for their personal financial interest.

Very good points Rhonda and you’re spot on about the BofA LO Twitter post – what a way to promote yourself. Is she really saying “I’m not really a trusted advisor but my bank will pretend to stop me from over-charging you.” Good advice to consumers – be aware, build a trusted relationship with your mortgage rep, and take responsibility for your financial affairs.

This made me laugh — The exact thought I had go through my head when I saw Jack’s column was…

“Uh oh. This guy has no idea what is going on in the trenches.”

Great post.

Jeff, I felt the same way… I did have a tweet loaded but decided to delete it… why would Bank of America (and Countrywide) have to re-earn the trust of consumers?

And then to see that the pricing is NOT better…I know many LO’s have left BOA due to their new compensation program…those who are happy to drink the BOA koolaide, being paid on by volumes closed per month (how is THAT better for the consumer) and to be fed leads by the bank…will stay.

Justin, I have found Jack to be much like our elected officials…in fact, I wouldn’t be surprised to learn that Congress relies on him for his opinions… he IS the Mortgage Professor after all.