Mortgage rates are priced with rebate, a credit towards closing cost, or discount points, an additional cost paid to reduce the interest rate (Note rate). The amount of the rebate or discount is based on a percentage of the loan amount. The difference in pricing (rebate or credit) varies throughout the day, just as mortgage interest rates change. In fact, it’s not so much that the mortgage rates change throughout the day, it’s actually the cost or credit associated with that rate.

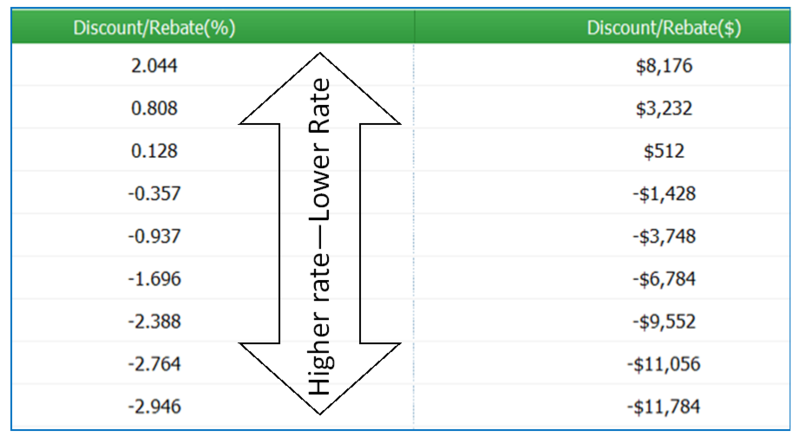

Here’s an example of pricing from earlier this month. I’ve removed the interest rate column as what I’m most interested in illustrating to you is how rebate or discount pricing works. I’m happy to provide you with a current rate quote based on your personal scenario for your home located anywhere in Washington.

The loan amount used in the above figure is $400,000 and when I priced this scenario, the borrower had the option of using just about any of price points (rebate or credit above) as long as they could document they had the funds to pay for additional discount points to buy down the rate or receive as much rebate as long as the rebate did not exceed the allowable closing cost, prepaids and reserves (rebate may not be paid to the borrower as cash).

Each line above is a difference of 0.125% in rate. For example, based on the above scenario, a borrower could opt to pay 0.128% in discount points ($512 more in closing cost) in order to have a rate that is 0.125% lower than the rate priced with a rebate credit 0.357% of the loan amount (receive a credit of $1428 towards closing cost). It’s the borrowers choice. The difference in mortgage payment for this scenario is roughly $30. The difference in closing cost between an 0.125% in rate with this scenario is $1940. Would you rather have a mortgage payment that’s $30 less or spend $1940 less towards closing cost. The answer totally depends on your personal scenario.

Rebate pricing works nicely with a refinance scenario since it helps the homeowner break even on closing cost much quicker. With how low rates are today, many may decide they would like to have their rate priced with enough rebate to cover all of the closing cost and are still dramatically reducing their mortgage payment.

This also works with purchases and if a home buyer is receiving a generous contribution towards closing cost from the seller, they may opt to buy the rate down with discount pricing.

Here’s some background information on mortgage rates. It used to be that rates were generally priced with either a flat 1% or 1.5% or zero points, however, since the Fed rule on Loan Officer Compensation, this is no longer the case. Borrowers now have rebate or discount pricing and the mortgage originator’s compensation is divorced from the rate or closing cost fee equation. The Fed no longer allows mortgage originators to have any influence on pricing on the rate, including contributing any of their compensation to the borrower. In the scenario above, pre “LO Comp” it was not uncommon for me to pay for a small discount, such as the 0.128% fee in order for my client to have a slightly lower rate – often times, I did this without ever letting my client know. The Fed Rule prohibits this.

When or if you do request to a rate quoted with “no closing cost” please understand that your quote indeed will have closing cost along with an amount of “rebate credit” to off-set those fees. You’re paying for the reduced closing cost with a higher rate than a quote priced without as much rebate. This is actually nothing new, banks and mortgage companies have tried to promote they offer no cost loans when odds are, their rates where higher to absorb the cost. I’ve written about that a few times here.

Bottom line, I want you to know that how your rate is priced is really up to you.

Rhonda, thanks for the article. When I ask about deciding between the two options, I’m often left with the answer “it’s really up to what you want to do”.

Is there a definite mathematical savings going one way or another when paying a loan off in 15 or 30 years?

I have enough money to pay any of the closing costs associate with each interest rate….but which one saves you the most money long term?

I keep telling myself it’s wiser to take the 3.125% loan now and pay the extra $6000 in closing costs but for the life of me I can’t figure out the real math.

The counter argument would be that with a $6000 up front savings (different between a 3.125 and 3.7 rate), that money could be spent on improvements need on the house now or invested in the market which historically would yield gains much greater than the increased price paid on the loan itself over 15 or 30 years.

Any thoughts on this topic? My broker suggests I go with something in the middle around 3.5% but part of me thinks that’s because his firm makes more money on the loan with a higher interest rate. Would I be dumb taking anything higher than the lowest rate I can get (especially considering I’ll never be able to refinance with an initial rate this low)?

Hi Patrick,

First of all, your broker should not have his compensation impacted by the rate you select per regulations passed by the Fed in April of last year (aka LO Comp).

It is personal choice. You do have savings if you no longer have a mortgage payment – you’ll lose the ability to deduct mortgage interest (assuming that still exists in the future).

For me, I tend to lean towards a 30 year fixed because it does provide flexibility with your mortgage payment – you can always pay down principal or stash away the funds you would be using towards a 15 year to build up savings. Then you’ll always have the funds to pay off or pay down the mortgage should you decide to.

If you opt for 15 year and need cash out in the future, you’ll need to qualify for a cash-out refi ….which also comes with closing cost.

As far as whether or not you should pay to reduce your rate – that’s also a personal call (forgive me). Has your mortgage originator provided you with amortization schedules based on the rates he or she is quoting? This may help you decide based on break even points.

Good luck!

Hmmmm good things to think about. I’m definitely not thinking of a 15 year vs a 30 but rather would try to pay off the whole loan within 15. That would be the most flexible for me but considering I’m single and have a lot of flexible income coming in at the moment it seems wise to pay it all off.

Also half of the square footage of this house is contained in a separate detached building which I can use as a my home office….which would make a lot of my mortgage deductible if the mortgage interest deduction ever was scraped off the books.

Lots to consider but it doesn’t sound like there is a clear right or wrong answer which means the liability can’t be that great….maybe the difference of $20,000-$40,000 over the course of 30 years.