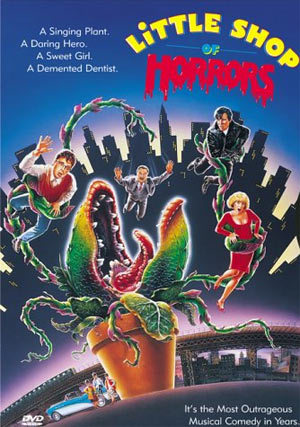

FEED ME, Seymour! I know this is probably a total blog no-no. But here goes… I am asking for your ideas on what I should blog about related to mortgage, hume buying, financial planning, real estate…you get the idea.

FEED ME, Seymour! I know this is probably a total blog no-no. But here goes… I am asking for your ideas on what I should blog about related to mortgage, hume buying, financial planning, real estate…you get the idea.

I’m suffering from blogger-block, which I’m sure will pass. In the meantime, I thought I’d reach out to you for your input.

Rhonda,

Just a note to tell you I love your blog. It’s great to get the straight skinny on the real estate mortgage market from a broker. You tell it like it is — how refreshing!

A suggestion: I’d like to learn more about the options people who’ve been through bankruptcy have when it comes to obtaining a mortgage.

My wife and I have had impeccable credit over the years and then made the mistake of following our “dream” and opening our own business. Our “dream” turned into a “nightmare” and we were forced to declare Chapter 7 bankruptcy in 2005. It has been 16 months since our case was discharged.

Much to our surprise, and partially due to careful credit management in the meantime, our current mid-range credit scores are just above the 680 point.

While are credit scores are seemingly decent, we have that ugly public-record black mark on our report.

We’d love to hear what you have to say. Unfortunately we no longer live in Washington or we’d be ringing your phone for advice. Do we have a reasonable chance at getting a mortgage that wouldn’t cost us a fortune each month?

Thanks.

Bob

Bob, you have excellent timing. I actually have an article that was scheduled to post this afternoon on bankruptcy and buying a home!

/2007/11/bankruptcy-and-.html

Thanks for the suggestion and for reading Mortgage Porter. 🙂

Good day Rhonda!

I found this site about working mortgage protection at home. I’ve considered giving it a try, I’ve always wanted to get a job that allows me to still be able to take care of household matters. My children are both below 5 years old so I really want to be hands on. The thing is, I am a resigned nurse and don’t really have much background in mortgage insurance. Though if I ever decide to push through, my sister who is in the mortgage industry for years offered to help me.

Please tell me what you think, could this be a good career move for me?

note: I posted the url of the mentioned site on my personal info since I’m not sure if we are allowed to post sites.

Flora, I have no idea if this is a good move for you. I’m not one for the buying or selling of leads and without getting too deep into the site you’re referencing, that’s what it looks like to me.

Hi,

I’m looking for information on zero down VA loans above $417,000. From what I understand depending on the area the property is located that limit can be higher. For example, I searched Snohomish county and came up with $567,500.

However, I sure don’t see rates anywhere and the rules for guarantee amounts look different from 7/31/2008 through 12/3/2008 than after 1/1/2009. I must admit I don’t really understand the “guaranty” totally.

Perhaps an article on VA zero down loan limits above $417,000 would be helpful.

Mark, I’m working on this for you. The challenge is finding lenders that are supporting the limits passed by HR 3221.

A post on VA mortgages is over due. Thanks for your request!

Rhonda, Any chance you could start posting the non-owner occ rates and parameters – this is the time to invest in real estate, so it’s info we can use. Thnx -Di

Rhonda, Can you address lease options and lease purchases? Have you seen these going on around King County? Thanks!

Lisa, I’m going to invite someone to write a guest post regarding lease purchase/lease options. Since I’m on the mortgage side, I don’t see the lease end.

Hi Rhonda – the spread between conforming and jumbo/super jumbo rates seem to be larger than historically the case. While conforming rates are dropping to very attractive levels, non-conforming rates are not.

Can you comment on why this might be and if you see non-conforming rates getting to more attractive levels in 2009 ?

There is a ton of information about how to check if a condo is FHA approved. But I can’t find anything about how to go about getting my condo approved. Is this some state secret. Where can I find the application, or who do I need to contact?