Both events are at the Seattle Center:

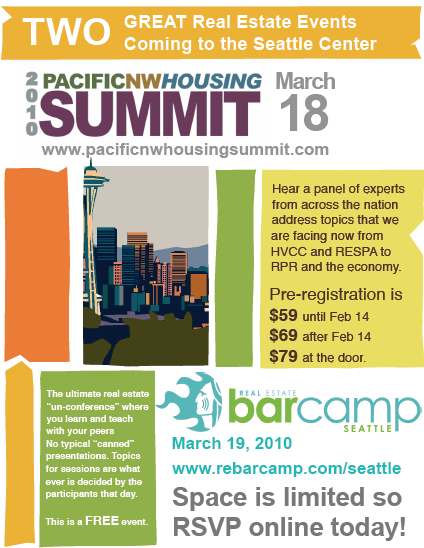

March 18, 2010 – Pacific Northwest Housing Summit

March 19, 2010 – RE Barcamp Seattle

The panelist for the Summit continue to grow and we anticipate quite a turn out from across the country at both events. Sponsorship opportunities are still available and start at $250.

Of course there will be "tweet-ups" and social hours following both days.

Be there! Follow both events on Twitter: @pnwhs #pnwhs and @REbarcampSEA #rebcsea

PS: Space is limited to the first 700 registered attendees for the PNWHS…and there's a "sweet heart deal" for pre-registrations by Valentines Day.

Recent Comments