USDA mortgages are available with zero down payment to borrowers under certain income limits who want to buy in a designated rural area. USDA provides maps that illustrate whether or not a geographical area is allowed to have this program.

The maps for USDA were set to be revised late last month with revisions taking place at the end of this month have been postponed by Congress. USDA mortgages are proceeding “business as usual” until they hear otherwise from “the hill”.

The orange areas of this map shows areas that are currently not eligible for USDA zero down payment financing.

Congress has introduced bills that would change how a rural area is defined, including increasing the population to 35,000 based on the 2010 Census which would allow more homes to be eligible for zero down USDA mortgages.

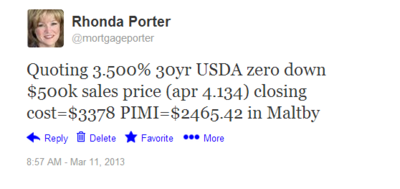

USDA loans offer very competitive rates. Just yesterday on Twitter, I shared a quote based on a USDA loan in the Maltby area in the mid 3’s for a 30 year fixed with zero down payment for a $500,000 sales price based on a family of 5.

In addition to the property being in a designated rural area, to qualify for the USDA zero down mortgage program, your household income cannot exceed the current income limits. Current household income limits for properties in King and Snohomish counties are $93,450 for a family up to 4 and $123,350 for a family of 5 to 8 members living in the home.

If you’re interested in a USDA zero down mortgage in Duvall, North Bend, Port Townsend or anywhere in Washington state, I’m happy to help you.

Discover more from The Mortgage Porter

Subscribe to get the latest posts sent to your email.

so as of today there will be no changes to the USDA territories? I have heared a rumor that at the beginning of april there will be a new updated qualifying territory.

What do you know about this? does USDA give us a grace period?

thanks for helping me out. I truly appreciate it.

nick

What I’ve been told is that it’s “business as usual” until Congress takes action.