Back on "Section X" of a residential mortgage loan application, borrowers are asked to check boxes to indicate what their ethnicity and race are.

It's not unusual when I take a loan application and the borrower wants to mark the box that it's none of the the government's business. I don't blame them…but I wonder if they're aware that when they check "I DO NOT WISH TO FURNISH THIS INFORMATION" that mortgage originators may be required to guess depending on how the application is taken.

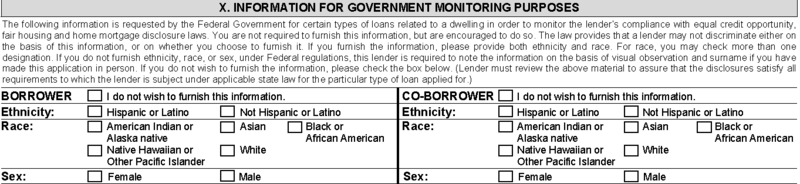

Check out the fine print on the loan application:

"If you do not furnish ethnicity, race, or sex, under Federal regulations, this lender is required to note the information on the basis of visual observation and surname if you have made this application in person."

I can tell you from days in the escrow biz, this can be kind of awkward when you're signing someone and the person across from you says "why is this box marked stating that I'm ….?!!" Your loan originator probably had to make their best guess.

The Home Mortgage Disclosure Act (also referred to as HMDA, pronounced hum-da) along with Regulation C requires lenders to collect this information to make sure that lenders are not discriminating.

From Fannie Mae:

X. Information for Government Monitoring Purposes

This section is included to aid the federal government in monitoring compliance with equal credit opportunity, fair housing and home mortgage disclosure laws. Supplying this information is strictly voluntary on the part of the applicant, but lenders should ask all applicants to provide it, including those who apply by telephone and through the Internet, and should describe the reason for collecting this data. Race and ethnicity are separate categories, and although the lender should ask applicants to furnish information for both, applicants may furnish one but not the other. Note that there is no longer a place for applicants to indicate race as "Other" but applicants may check as many races as apply.

The Home Mortgage Disclosure Act and its implementing Regulation C generally require Lenders to collect sex, race and ethnicity data on all applications.

When an application is taken in person and an applicant elects not to provide some or all of this information, federal law requires the lender to note the applicant's sex, ethnicity, and race on the form, based on the lender's visual observation or the applicant's surname. To aid in identifying applicants who may be of Hispanic ethnicity and who elect not to self-identify, the lender may wish to consult the list of Spanish surnames developed by the U.S. Bureau of the Census. Furthermore, the lender may wish to advise the applicant that he may complete or change the information in this section after the application is approved, at any time up until closing.

And from HMDA:

If an application is taken entirely by mail, Internet, or telephone, and the applicant declines to provide information on ethnicity, race, or sex, the lender must use the code for "information not provided by applicant in mail, Internet, or telephone application."

The only way to not participate in disclosing your ethnicity or race on a loan application is to completely apply on line or mail. I'm wondering, if a person understands why this information is being collected, why would they not want to participate?

Discover more from The Mortgage Porter

Subscribe to get the latest posts sent to your email.

Please leave a reply