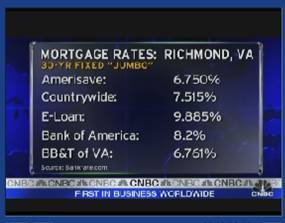

I typically have CNBC on while I’m working. This morning, I watched in dismay as Diana Olick of CNBC used Bankrate to compare jumbo rates. What on earth was she thinking?

Bankrate does not have a sterling reputation for posting accurate mortgage rates. In fact, they settled a lawsuit from their advertisers (the mortgage companies who are listed at Bankrate’s site are paying to post rates) using bait and switch with the rates they are promoting.

Bankrate does not have a sterling reputation for posting accurate mortgage rates. In fact, they settled a lawsuit from their advertisers (the mortgage companies who are listed at Bankrate’s site are paying to post rates) using bait and switch with the rates they are promoting.

I just visited Bankrate for a jumbo mortgage using 20% down in Seattle. Here’s an example of actual rate quotes I received priced at zero points/zero origination:

Lender 1: APR 8.017% – Rate: 8.000% – APR Fees: $815

Lender 2: APR 7.428% – Rate: 7.250% – APR Fees: $8740

Lender 3: APR 8.200% – Rate: 8.125% – APR Fees: $3500

Lender 4: APR 6.787% – Rate: 6.625% – APR Fees: $8278

Lender 5: APR 9.855% – Rate: 9.875% – APR Fees: $410

How can there be such a variance in rates that are priced at zero points and zero discount? Check out the closing costs shown as APR Fees…try telling me points aren’t factored somewhere in with Lenders 2 and 4. It’s misleading and this is similar to the example used on CNBC this morning. Worse, CNBC did not include the fees when they were showing the rates. Good drama, bad reporting.

The media is digging the mortgage crisis. They are sensationalist who thrive on bad news. Yes, we are in historic times with the mortgage industry. This is why it’s so important for consumers to select qualified mortgage professionals instead of the lowest rate on they believe they’ve found on the internet.

Discover more from The Mortgage Porter

Subscribe to get the latest posts sent to your email.

Bankrate= Bait & Switch Mortgage Advertising

Bankrate Faces Antitrust Lawsuit http://www.forbes.com/feeds/ap/2007/08/0…

If the aggregation and dissemination of Bank Rates are controlled by a

single hub or entity — Bankrate — acting as an unregulated central

Banking Exchange, the opportunities for market manipulation and abuse of

market power increase exponentially, with potentially catastrophic

consequences for the entire United States consumer banking and mortgage

markets, and any other related markets.

“You don’t have to take our word for it when it comes to Bankrate’s abuses; Bankrate’s own words best and most reliably describe how its conduct violates federal and state antitrust laws,” said Norbert Mehl, BanxCorp’s founder and CEO. “We encourage regulators around the country to take a close look at the consumer harm Bankrate’s business practices are causing, and how its monopoly position is causing detriment to banking and mortgage customers and adversely affecting a market that is critical to our nation’s economy.”

In fact, on May 2, 2007 during its First Quarter 2007 Earnings Call, Bankrate’s President and CEO, Thomas R. Evans, stated as follows:

“One of the things that is a tremendous gating item for us, we believe is

in terms of competition, and barriers for competition, is how does anybody

else break into this, if we have tied up all the best newspaper relations,

the best co-brand relationships and we’ve got a dynamic organic traffic

website. How does anybody else get into this business and compete with

Bankrate?”