Recently a friend approached me confessing to having one of those "awful adjustable mortgages"…she thinks she needs to refinance and take advantage of today’s lower rates. Before assuming that someone "needs" to refinance, I like to review their current mortgage and what their financial goals are. Sometimes, people do not need to refinance…they just need to understand their mortgage terms.

Current Mortgage: P&I Payment $3,330 (original balance $520,000).

- 7/1 Adjustable Rate Mortgage: Note Rate 6.625%

- Caps: 2/2/5

- Margin: 2.25

- Index: 1 Year LIBOR (currently 2.637% as of this the date of this post).

There is approx. 65 months remaining with the fixed period rate of 6.625% before the mortgage adjusts. When the mortgage adjusts, the new rate will be 2.25% plus the current 1 year LIBOR rate EXCEPT the rate will be no lower than 4.625% and no higher than 8.625% due to the 2% adjustment cap.

Best case scenario at first adjustment date with current mortgage:

Rate: 4.625% with principal and interest payments for 12 months of $2,780. Note: If the mortgage was adjusting today, the rate would be closer to the best case scenario at 4.875% (2.25% plus 2.637% = 4.887% rounded to the nearest 0.125%). Alas…they have 65 more months before knowing what the going rate for the 1 Year LIBOR will be.

Worse case scenario at first adjustment date with current mortgage:

Rate: 8.625% with principal and interest payments for 12 months of $3,937.

Possible scenarios that I suggested:

Refinancing into a conforming-jumbo mortgage 30 year fixed at 6.375%. This would provide a principal and interest payment of $3,232. With closing costs at $2900, they will break even on this scenario in 30 months. From 30 months (the break even point) to when the fixed period of the ARM is over, the savings based on the monthly payment would be $3430.

Restructuring the existing mortgage into two mortgages with a conforming first at $417,000 at 5.875% and second mortgage paying off the balance (they can opt for a fixed second or a HELOC). With a principal and interest payments of $3,194 and closing costs of $3,200; it will take 24 months to break even on this scenario. From 24 months to when the fixed period of the ARM is over, the savings based on the difference between the monthly payments would be $5,576.

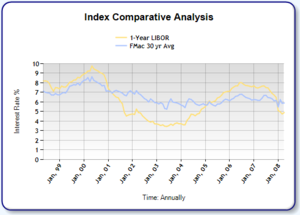

This chart, which I created utilizing The Mortgage Coach, is factoring in the 2.25% margin to the LIBOR rate back to January 1999. You can see there is a significant range with the rate. Home owners with ARMs based on the LIBOR rate from 2002 to 2004 were probably grinning from ear to ear (depending on what their margin was) when you see what their rate was compared to the 30 year fixed. Timing is everything with an adjustable rate mortgage.

This chart, which I created utilizing The Mortgage Coach, is factoring in the 2.25% margin to the LIBOR rate back to January 1999. You can see there is a significant range with the rate. Home owners with ARMs based on the LIBOR rate from 2002 to 2004 were probably grinning from ear to ear (depending on what their margin was) when you see what their rate was compared to the 30 year fixed. Timing is everything with an adjustable rate mortgage.

What ever the home owner decides to do is completely up to them. Of course one of their options is to not refinance and wait to see what the new rate (LIBOR) will be in 65 months. If they wound up with a "best case scenario" new payment, it would be pretty sweet however the cost of paying the higher payment for 65 month and we don’t know what the index will be at the date of adjustment. Understanding your mortgage and knowing your available options just starts with contacting your local Mortgage Professional.

By the way, if you are a Washington State home owner who has not heard from your loan originator lately or if you would like me to adopt your mortgage, please contact me. Many LO’s have left the industry or do not provide service once the loan has closed. I’m happy to review your ARM (or fixed rate mortgage) without any obligation to refinance.

Recent Comments