With the recent passage of the American Tax Payer Relief Act of 2012, Congress extended the ability to deduct mortgage insurance the same as qualified residence mortgage interest. This applies to homes with private mortgage insurance, FHA mortgage insurance (upfront and monthly) as well as VA and USDA funding fees.

A qualified home, as described by the IRS, is your primary residence or your second home. You cannot collect rent on your second home or it’s…. (are you ready for this?) an investment property and not eligible for this deduction.

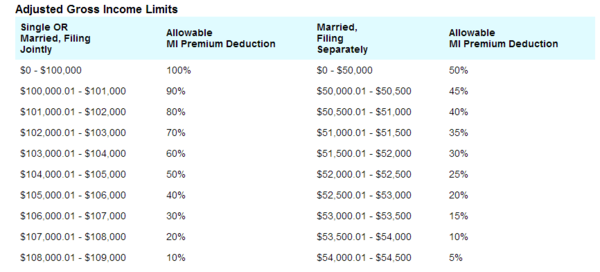

This benefit is phased out for adjusted gross incomes over $100,000. Here is a chart compliments of MGIC regarding how much one may be able to deduct based on AGI:

The amount of mortgage insurance paid is disclosed on the Form 1098, along with the mortgage interest that was paid during that year.

For more information, please contact your personal CPA or tax professional. I am not a CPA, I am a Licensed Mortgage Originator for homes located in Washington state. If I can help you with your mortgage needs for your home located in anywhere in Washington, including Seattle, Sequim or Snoqualime, please contact me.

Discover more from The Mortgage Porter

Subscribe to get the latest posts sent to your email.

I received my 1098 but it did not show the mortgage insurance premium i paid for 2012. When I called my lender they said they were told by the IRS that this is no longer to be deducted. If the deduction has been extended, why did they leave it off, can i still claim it and how do i receive that information? thanks for your help!

I received a letter from my lender stating a corrected 1098 will be sent out including the PMI since the deduction was extended. The original 1098 DID NOT include box “4”

Hi Rosa, here ya go: http://www.irs.gov/publications/p936/ar02.html#en_US_2012_publink1000296058

Hi Rhonda. This is good information to share.

Upfront MIP – Single Premium

An upfront MIP, paid at closing, is tax deductible over a period of time. The IRS permits a home buyer to deduct FHA/USDA/VA upfront mortgage insurance/funding fee premium as long as the deduction is taken over a period of 84 months.

One-seventh of the funding fee paid at closing can be deducted each year for seven years unless the home is sold.

Once the home is sold, all MIP tax deductions end.

Rhonda,

I paid PMI in 2012. After breaking down my numbers from the mortgage statement, it is not included in the interest payment (box 1) or my Real Estate taxes paid (box 4).

It was not reported on my original 1098 (no line for it in box 4). However, upon looking up my 1098 on the website of my mortgage payments, it shows 0 for the amount…

Going back, I’ve spend ~626 on PMI over the year based on my statements.

Is there a reason it wouldn’t be deductible or do you believe this to be a mistake on the behalf of the mortgagor.

(Originally the loan was an FHA loan, first time home-buyer.)

I would contact your mortgage lender and your CPA, Nick.

When did you obtain the mortgage?

2009 originally. I have not reached the 20% threshold. Contacting my mortgage lender is proving… slow and difficult.

I don’t use a CPA, I’m a DYI type. Plus, the tax benefit of this deduction would not offset the cost of consulting a CPA or Tax Prep professional.

Thanks for the help!

Just following up to let people know what happened.

My mortgage company has sent out a revised 1098 showing the amount of PMI paid. They included a note that says that the Taxpayer Relief Act of 2012 reinstated the requirement for mortgage lenders to report premiums paid in box 4 of the 1098.

The amount now shows up correctly on the revised 1098 they sent out. I wouldn’t be surprised if this is happening all over.

Thanks Rhonda, yours was the only information I found that made me certain that my original 1098 was incorrect, as a result, I held off on filing and won’t have to do an amended return now.

I’m so glad my post was helpful!

Hi I used my VA loan and was charged about $5,600 for a VA funding fee, it does not show on my 1098 anyway, but I understand it is tax deductible for 2012.

The VA says it does not issue any 1098, this fee only shows on my HUD 1. Any advice on how to obtain this info on a 1098?

Hi Roger,

You need to contact where you make your mortgage payment to.

Good luck!

I obtained my mortgage in 2004, and have been paying PMI ever since. Can I claim the deduction?

Lee, please contact your CPA or tax professional. This is from the IRS link (above): The insurance must be in connection with home acquisition debt, and the insurance contract must have been issued after 2006.

With that said – I specialize in mortgages 🙂 not income taxes.

I received a statement from my bank with the MI amount paid. It’s supposed to be reported on line 13 of schedule A – however, line 13 of sch. A is “Reserved” and is highlighted. Is this still where I put my deduction?

Based on all the criteria I can find in the IRS publication, I should be entitled to deduct the mortgage insurance. But when I contact my mortgage bank, they insist that it is not deductable for 2012 tax year and won’t give any further information.

If the public has a grievance such as this, is there any means of contacting the IRS or some other group to try to force the issue?

I filed my taxes and then received a corrected 1098 from my mortgage lender showing mortgage insurance paid that was not on my previous 1098. Am I now required to file an amended return?

Hi Candi,

Please contact your CPA. You may qualify for credit for a portion of your mortgage insurance premiums paid in 2012.

Thank you Rhonda. Honestly, I’m just wondering if I will get in trouble with the IRS if I don’t amend my return already filed.

Hi Candi,

Please check with your CPA or tax advisor. I’m not a tax expert… I’m a mortgage expert.

Hi there! I purchased a home through USDA in 2013 and had the 2% Guarantee Fee rolled into the principal loan amount. Can the entire fee be deducted for 2013?

Hi Victoria, it will probably be treated the same as upfront MIP since it’s amortized over the life of the loan – so the entire fee would not be deducted in 2013 since you technically are financing the guarantee fee. If you paid the 2% guarantee fee as a closing cost with cash, instead of financing it, then the entire amount could be deductible. Please confirm with your CPA. I’m a mortgage expert – not a tax expert.