The SAFE Act was enacted in July 2008 to help create a national standard for residential mortgage originators. This is a fantastic idea EXCEPT that if a mortgage originator works for a depository bank, like Bank of America, Chase, Citi or Wells Fargo (just to name a few) they are excluded from licensing. Mortgage originators working for a bank will only have to be registered…and yes, there is a difference.

In Washington state, Licensed Mortgage Originators, per the SAFE Act, are required to:

- submit fingerprints for a state and federal background check

- submit personal history and experience (MU-4 form)

- will have a unique identifier number. (I’m NMLS MLO-121324)

- demonstrate financial responsibility (LO’s will have their credit checked)

- take 20 hours of approved pre-licensing education

- pass the state and national mortgage exam by 75% or better

- will take 8 hours of continuing education annually

- may never have had a license revoked (I’ve been licensed with DFI since 2007)

Registered Mortgage Originators aka Federal Mortgage Originators (those who work for depository banks and who are not required to be Licensed) per the SAFE Act, are (eventually) required to:

- submit fingerprints for a state and federal background check

- submit their personal history and experience (MU-4 form)

- will have a unique identifier number

A registered mortgage originator banker will probably tell consumers that they don’t need to do all the measures that a licesned mortgage orignator does because it’s in house (ask them and listen to their response) —so why not be held to the same standards as a licensed mortgage originator? Why not try passing the national and state exams? NOTE: If a non-licensed mortgage originator (registered mortgage originator/banker) tries to tell you that mortgage brokers are licensed because they are the cause of the mortgage crisis, please remind them that it was the mortgage banks that created and underwrote the mortgage programs AND it is the mortgage banks who hired their reps to call on mortgage brokers to push their programs.

If Congress truly wanted to serve the people, they would have created the same standards for all mortgage originators regardless of campaign contributions, lobbyist, the type of institution they’re employed by. Consumers should not have to sort out the differences between a Licensed or Registered mortgage originator. ALL MORTGAGE ORIGINATORS SHOULD BE LICENSED.

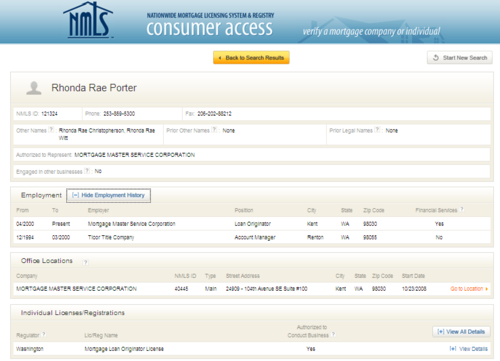

Here’s what my profile looks like on the NMLS Consumer Access site. You can click the image below to see a larger image or visit http://www.nmlsconsumeraccess.org/ and either enter my name and Washington State or my NMLS LICENSE Number: 121324.

Towards the bottom of the NMLS Consumer Access site, you can see if your mortgage originator is licensed and which states they are currently licensed to originate mortgages in. If the mortgage origninator is not licensed and are only required to be registered, it will state: “Federal Mortgage Loan Originator”. If your LO is a Federal Mortgage Loan Originator, they are not held to the same standards per the SAFE Act as a Licensed Mortgage Loan Originator. Period. When a “FMLO” tells you they’ve been regulated far longer than MLOs, simply point to Washington Mutual, Countrywide or World Savings and how successful the federal regulators were overseeing mortgages for those banks.

I encourage consumers to do their own research on mortgage originators BEFORE they start working with them. Depending on various factors, at the time of the publishing of this post, they may or may not be entered into the registry (especially if they work for a bank). Do check them out. Consumer Access by the NMLS does provide you with a history on your mortgage originators IF they’re in the system. If they’re not in the system find out why. And of course, you can always “Google” the mortgage originators name to try to learn more about them.

Mortgage licensing is actually the very issue that launched me into blogging over three years ago. I was bothered by the misinformation by the media that “all mortgage originators” are licensed which was not true.

Who would you rather have assist you? A mortgage originator with a license they must maintain (or they risk losing it) or someone who is simply registered

Related post: Are Washington Consumers safer working with a DFI Regulated (Licensed) Loan Originator

Hi there would you mind letting me know which web host you’re working with? I’ve loaded your blog in 3 different internet browsers and

I must say this blog loads a lot quicker then most.

Can you suggest a good internet hosting provider at a reasonable

price? Thanks a lot, I appreciate it!

Thanks! I actually just changed my web hosting to: http://www.copyblogger.com/wordpress-hosting/

I have to say, this is one of the most helpful articles I have read in a while. I often have the need to look up NMLS numbers; however, no one I have ever asked could tell me how to tell the difference between an individual who had actually taken the time and energy to get a license and someone who was simply registered.

Thank you again!

Great Article! It’s a bit old but I’m hoping the information is still current. Today I rejected working with someone who isn’t licensed and opted for someone who is.

It’s still accurate. Good for you for selecting a licensed loan officer – at least in this case, if something goes terribly wrong, you can work with someone on the state level instead of federal.

You are such a dweebette. Don’t you know NMLS tests are rigged to fail? Pass rate today is 68%

Another reason to work with a mortgage originator who can pass the test! Often, LO’s who cannot pass the NMLS test wind up becoming loan officers at banks or credit unions where they are not required to be licensed and therefore, do not have to pass the NMLS test.

Rhonda is correct in that one can work at a bank without passing any NMLS test. And Bill, the NMLS tests are tough, but they are not “rigged to fail”. They are tough, though, mostly because of all the latest federal regulations in the industry that are tested, but newbies have little or no exposure to. It is hard to pass a test on a subject that you know nothing about, I’ll agree with that!

I passed the national exam but I work for a depository. Is that good or bad? Should I do a mu4 and get a license for a state? The bank wont pay for the license because I only need to be registered there?

I know a lot of MLO’s that pass the National NMLS test but not their backgrounds, due to bankruptcies or bad credit, usually due to divorces, medical reasons or periods of unemployment. This is unfortunate for them, because many of them are good MLO’s and good people.

I also know a few that don’t pass the background check because the courts and FBI don’t update records with the corrected updated information and this prevents getting licensed in many of the states. Many people in my office only have 10-20 of the 50 state licenses, because each state has their own rules and benchmarks…… it needs to be uniformed.

I believe that if there is an extenuating circumstance, a Loan Officer may still be able to obtain a license – especially following the housing crisis. However, if a loan officer has a history of making poor financial decisions and/or mismanaging their credit, then they probably will have a tough time getting a license.

If I were a consumer, I would want to work with a mortgage professional who historically has had a good credit history and is financially responsible…especially considering that often times, a part of our jobs is providing consumers advice on credit and financial matter relating to credit.

Thanks for your comments, Tom! LO Licensing is why I started this blog! 🙂

This is a great article…. I am now a licensed originator for the past 2 years. Before that I worked for large federal chartered lending institutions that did not require the licensing.

I agree, all originating LO’s should be licensed period! Too many opportunities for people off the street to get into this industry and muddy the waters of what is already a challenging post Dodd Frank mine field of rules.

Rhonda, I understand the frustration from your point of view, and don’t disagree on some points. In your discussion of requiring the same process for all lenders there is a large missing component. Banks are regulated and MLOs required to have training courses above and beyond what a state MLO would be subjected to. Banks are examined frequently under safety and soundness and compliance federal examiners, then audited for credit quality, compliance and much more. We (Banks) have far more to fear in allowing rogue officers to originated outside of the established quidelines. My community bank has ceased providing mortgages because of these laws. I am a Compliance Officer for the bank. Anyhow, thought I would add this to the thought process.

Hi Dana, thank you for your comment. Ultimately bank LO’s and credit union Lo’s and non-depository LO’s should all be held to the same standards. Today, they are not. To say that because banks are regulated, the LO’s are fine is not all together true… we saw Washington Mutual, which was under two regulators and what a fiasco that was. How about what Wells Fargo has been recently going through?

It’s been my experience that most large banks have “application takers”… even the teller at my local bank will try to see if they can start “selling” me on getting a mortgage.

With that said, I also know of some excellent loan officers at banks and I’m sure there’s some not so great LO’s at non-depository mortgage companies, too.

Thanks for this info. Rhonda it’s much more than NMLS or the other regulators have provided to consumers, regarding what NMLS licenses even are! It makes me pretty upset that we go thru all the trouble of obtaining and keeping these licenses only to have people not even know what they are. I also am so sick and tired of Realtors advertising for loans on social media FB in particular and not even having an NMLS license or the knowledge needed!!

My parents took out a reverse mortgage in 2010. I have contacted NMLS and there is no registration for the loan officer. According to NMLS she shouldn’t have been able to do a mortgage of any kind without being registered. Is that true? I was told she could work under the banks license.

Pam, if she is originating a mortgage, she had to be either licensed or federally registered, which is most common if someone works for a bank or credit union. A person cannot originate a mortgage under a bank’s or mortgage company’s license.

Half the MLO’s in banks would be gone if held to the same rules….. A depository would have to be twice as hard on MLO applicants if held to the same rules because many banks do business in all 50 states and it would be a nightmare to sort out which MLO’s can do loans in which states and who take take incoming calls from which states and it’s a mess……… Depositories would be very short handed in that case, trust me. That’s why they get a break.Smaller lenders usually don’t do origination’s in all 50 states like the big banks.

You’re correct Tom, at least half of LO’s at banks would be gone if they were held to the same standards as LO’s who are licensed vs just registered. Although I disagree with your reasoning on why the SAFE Act does not require bank and credit union Loan Officers to be be licensed. I think you need to follow the dollar. Why would Congress not want all Loan Officers to be held to the same standards per the SAFE Act? In my opinion, the bank lobbyist worked pretty hard at preventing bank and credit union LO’s from being licensed. Bank and Credit LO’s are worth less in the market place to an employer because they have not gone through the licensing process, which includes passing state and national exams. As you referenced, many of these LO’s are not capable of passing the exam (or they simply don’t want to). Banks and credit unions are able to pay their LO’s less income because they are not licensed. And honestly, those bank and credit union LO’s are often “gravy fed” leads anyhow – again supporting my theory that LO’s who work for banks and credit unions do not have the same value as a licensed loan officer.

With that said, I think consumers should not have to know the difference between a licensed and non-licensed/registered loan officer – all Loan Officers/Mortgage Originators should be held to the same standard. If someone cannot pass the exam, they should not be originating mortgage. Today, if someone cannot pass the exam, they can work for a bank or credit union.