Update February 17, 2009: The American Recovery and Reinvestment Act has modified this tax credit posted here. If you're a first time home buyer who purchased January 1, 2009 – December 31, 2009; click here. If you purchased from April 9, 2008 – December 31, 2008; this post still applies to you.

Please check with your CPA or tax advisor to see how this impacts you.

With the recent passage of HR 3221, people who have not owned a home for the last 3 years may qualify for an interest free loan from Uncle Sam of up to $7,500. Here's a quick skinny on how this works:

3 years may qualify for an interest free loan from Uncle Sam of up to $7,500. Here's a quick skinny on how this works:

First time home buyers may receive a tax credit of up to 10% of the purchase price of the home (not to exceed $7500). This is a "tax credit" meaning that you receive the credit (if you want it) after you file your income taxes. For example, this means that when you file your taxes in 2009 and you owe $5,000 to Uncle Sam and you qualify to have a tax credit in the amount of $7,500; you would receive a refund of $2,500. However, this is a refundable credit (aka interest free loan) that must be paid back each year to the IRS (when you file your taxes) over the next 15 years.

If you sell your home before the tax credit is repaid to Uncle Sam, then the full amount is due or if your property that you received the tax credit for is no longer your primary residence (i.e. you convert your home to a rental).

This credit does not apply if the first time home buyer is buying a home from a relative.

This tax credit is only available for purchases made between April 9, 2008 and July 1, 2009 for adjusted gross incomes of up to $75,000 ($150,000, if married, filed jointly) and phases out up to $95,000 ($170,000, if married, filed jointly).

Should you take advantage of this opportunity?

Sure! Who wouldn't want a $7,500 interest free loan? Two things I would consider using this credit for if I were a first time home buyer:

- investing into an interest bearing savings account to build my "emergency fund".

- pay off a nasty high interest credit card (freeing up a monthly cash flow).

- fund your IRA.

Just understand that this is essentially an interest free loan. This is not "down payment assistance". You will be paying this back over the next 15 years (or sooner if you sell, rent out the property or convert it a second home)…but you just can't beat "interest free".

For more information, click here.

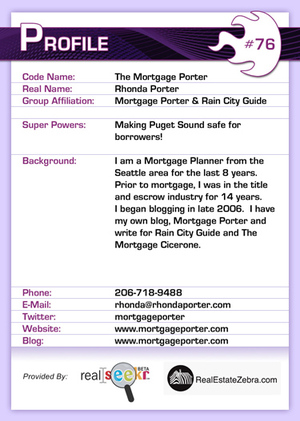

Friendly reminder: I am not a tax professional, I am a Mortgage Planner assisting families who need mortgages in beautiful Washington State. Always consult with your CPA, financial or tax advisor.

Watch for more posts on the effects of HR 3221.

Recent Comments